Several Big “I" state associations are working on creating an agent-focused annual property-casualty marketplace summary. The report focuses on agent penetrations in lines of business, loss ratios, leading insurers, growth rates and commission rates.

I have been working with several Big “I" state associations on creating an agent-focused annual property-casualty marketplace summary. The report focuses on agent penetrations in lines of business, loss ratios, leading insurers, growth rates and commission rates.

The report will increase understanding of the state p-c insurance marketplace, what is written by agents and, also, what is not. The summary should give the member agent a frame of reference for what lines of business are growing and what insurers are leading writers, as well as what lines are experiencing loss ratio stresses.

The perspective of the report is hard industry data but always from the independent agent's perspective. We have been seeking to perfect the report and produce it in June or July next year as the industry data comes together for the 2020 calendar year.

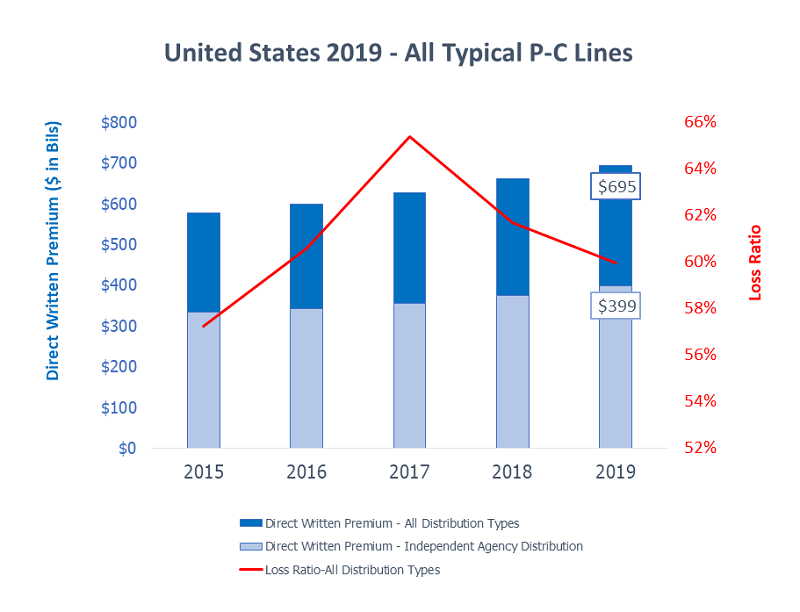

Some results from the 2019 data are worth sharing from a national perspective. For example, while penetrations by agents vary a lot across various lines of business or between states, nationally it's a very stable picture overall.

Below is direct written premiums in the U.S. through independent agents from 2015 to 2019 compared to total distribution. Since 2015, independent agent premiums have been nearly in lockstep with total premiums, growing at about 4.5% per year, compounded. Penetrations are nearly constant at 57%.

Source: © A.M. Best Company

Source: © A.M. Best Company

Where does this data come from? That is the story behind the story.

Every insurer domiciled in the U.S. has to file an annual report with the insurance commissioner where they are located. You may know those required insurer reports by their colloquial name in the industry: "yellow books." If you are familiar, it may have occurred to you that the insurance industry is a great example of big data but our industry has been doing its thing since the 1930s.

This data lets you see a lot. One very important page in particular—Statutory Page 14—makes a state-by-state report possible.

Statutory Page 14 includes direct written premiums, direct earned premiums, losses and some key expenses like commissions and brokerage expenses. The page gives you those figures by 34 lines of business.

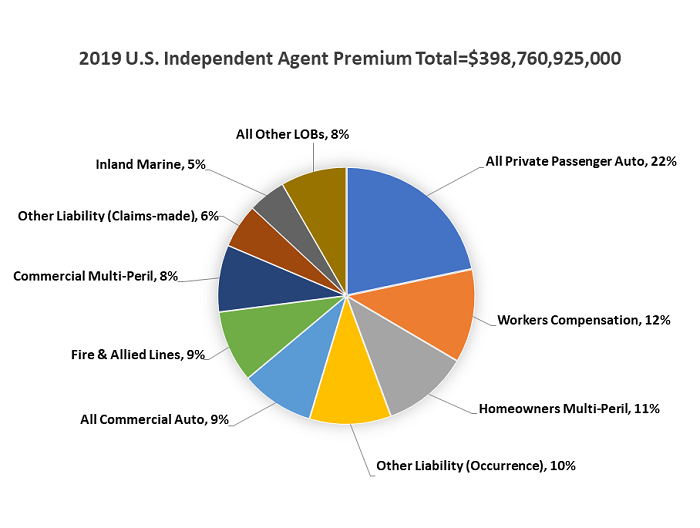

Those p-c lines of business include aircraft, warranties and everything in between. Below are the nine biggest groupings of premiums, with the 10th being all the rest as written by insurers marketing through independent agents for the entire U.S. That “all other lines of business" category includes surety, medical malpractice, products liability, ocean marine, farm owners, aircraft, fidelity, boiler & machinery, burglary and some less-often-seen lines like warranties.

Source: © A.M. Best Company

Source: © A.M. Best Company

So how did we get to 34 lines of business? The best answer I've gotten is evolution.

The story of Statutory Page 14 is a long one, going to back to when insurers first began filing annual statements with their regulators. Over many decades, lines of business have been added while others have been created for combinations. Sometimes it can be hard to match up policies agents write with the various lines those premiums fall into, but knowing the line-up has evolved as old policies are combined and new ones are added helps.

As I work with states and the data from the 34 lines of business, I wonder what Dmitri Mendeleev would do? For those of you that remember the name from high school chemistry class, he created the earliest periodic table of elements as a way to organize the physical world. What would he have done to track premiums by its various components?

Paul Buse is operations and strategic advisor, Big I Advantage®, until Dec. 31, 2020, after which he will be launching a new consulting operation, Real Insurance Solutions Consulting.

This Student of the Industry article is part of a monthly column on IAMagazine.com. Keep an eye on Thursday's weekly News & Views e-newsletter in January for the next off-beat take on current trends in the insurance industry.