Do property-casualty insurers really buy insurance from other insurers? Yes, they do—$700 million of it. Could one be your next client?

Do property-casualty insurers really buy insurance from other insurers? Yes, they do—$700 million of it. And I am not talking about reinsurance. I am talking about the insurance that Big “I" members like you sell their commercial clients every day.

The need for a deep dive into how much insurers pay for insurance was prompted by questions regarding smaller mutual insurers, and specifically how much directors & officers premiums were rising. If you are a regular reader of this column, you may have already received some insight on that from an article on D&O last year.

It turns out, like much of the D&O market, when it comes to how much small mutual insurers pay, you can add 25% to last year's premium…if you are fortunate.

Sidebar: I was impressed at the number of prospects in this target market. Most policies sold are from uber-large insurer groups with full-time risk managers, in-house insurance agencies and a reliance on the top 10 brokers. But don't discount the hundreds of smaller specialty insurers you might have a relationship with. Someone is serving their risk management needs—why not you?

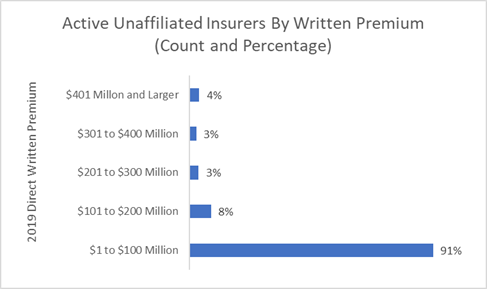

To make the point, if one narrows the total target market of insurers to only unaffiliated insurers, you end up with 523 licensed insurers in 2019 with at least some written premium. Interestingly, there are about twice that many independent insurers with at least one insurance license, but many are not writing any premium. They too may still need insurance from an agent but we will concentrate on the active, unaffiliated, independent insurer marketplace.

As you can see below, the vast majority of these insurers have premiums below $100 million. What's more, nearly every state has unaffiliated insurers domiciled within their borders. Only New Hampshire and Wyoming are without an active, unaffiliated insurer domiciled in their state.

Source: © A.M. Best—used with permission.

So, what's the point? Well, commissions!

These insurers, if similar to other corporations, incur an annual “cost of risk" approaching 1% of revenues. That includes deductibles and other risk management costs, but the insurance portion of their cost of risk brings with it a commission to someone.

That may seem obvious but, the fun part with p-c insurers is that we actually know how much insurance they purchase.

Insurers all file very detailed financials with their regulators. Part of that statement includes a disclosure of how much they pay for insurance protection. That includes public liability, buildings, contents, autos, workers compensation and more. That information is filed annually with their primary regulator.

Below is data taken from the 2019 annual statements and unaffiliated insurers insurance expense.

523 Unaffiliated P-C Insurers: Expenditures on P-C Insurance

| % Cost of Insurance | Actual Insurance Dollars | Insurer Direct Written Premium |

Median

| 0.35% | $42,000 | $13,743,500 |

Total

| N/A

| $60,961,000 | $34,899,603,000 |

Source: © A.M. Best—used with permission

As you can see, the typical unaffiliated insurer spends about $42,000 a year on their p-c insurance—and that typical insurer is not very big at about $14 million in direct written premium. All independent insurers combined spend nearly $61 million.

As a measure of “typical," I used the median. The average is actually over two times as large as the median but I could see that figure is skewed by five very large unaffiliated insurers, which are less likely to be prospects. The median, or the middle-of-the road between the smallest and largest figure, is a better measure here for a typical target insurer.

Also provided is the median insurance cost as a percentage of written premium. If you are wondering about a particular insurer, use that as a factor against its direct written premium for a specific estimate. You can get any insurer's “yellow book" quite readily from most state regulators, from the National Association of Insurance Commissioners or from A.M. Best and other industry data aggregators. As an example, a $25 million premium p-c insurer would likely have an estimated insurance spend of $87,500.

The bottom line?

With the average commissions on commercial p-c insurance at 14.1%, that would be commission income of about $12,338 for the independent agent for the $25 million insurer. If you have a relationship with an unaffiliated insurer, it is worth an attempt.

Paul Buse is principal, founder and owner of Real Insurance Solutions Consulting.

This Student of the Industry article is part of a monthly column on IAMagazine.com. Keep an eye on Thursday's weekly News & Views e-newsletter in April for the next off-beat take on current trends in the insurance industry.