If you're using an insurer that pays dividends—or competing against an insurer that does—you should know their impact.

Recently, I saw a summary of the refunds, credits and returned premiums paid back by the property-casualty industry to policyholders due to COVID-19. Almost $13 billion—2% of 2020 direct written premium—was paid out to insureds as a result of the coronavirus pandemic.

Of that total, almost half was added to policy dividends. That had a major impact on dividends paid out, particularly on automobile insurance dividends.

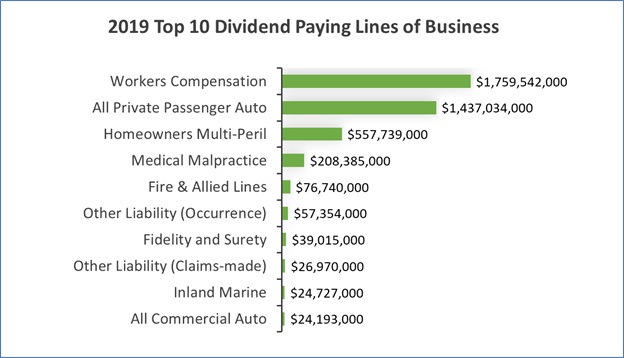

To gain some perspective, below is a summary of the total dividends paid out in 2019 on all lines of p-c business. You can quickly see dividends are paid on a wide variety of lines of business, but workers compensation pays out the most. In total for all lines in 2019, dividends totaled $4.2 billion or about two-thirds of 1% of 2019 direct written premium.

Source: A.M. Best Company—used with permission

Do not conclude, however, that because dividends paid out are less than 1% they are insignificant. For homeowners in 2019, insurers average dividend payment rivaled commissions paid, the latter of which is the greater insurer expense at 10.4%.

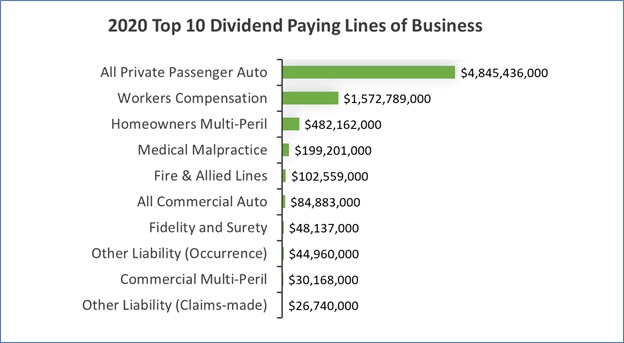

Now, let's turn to the 2020 summary of dividends to see the impact of adding $3.7 billion in COVID-19 payouts. Below you can see that the personal auto line of business displaced workers compensation to take the No. 1 spot. You can also see that, overall, dividends increased almost 100%—from $4.2 billion in 2019 to $7.5 billion in 2020.

Source: A.M. Best Company—used with permission

These charts come from the appendices in the p-c marketplace reports I do for several Big “I" state associations. But why do I include dividend information? If you're using an insurer that pays dividends—or competing against an insurer that does—you should know their impact. Dividends have a long history of encouraging customer loyalty with payouts for good loss experience or to reward effective loss control.

If you offer a product that pays dividends, make sure you highlight that with your client. As students of the industry you should already know, but if you don't know the dividend history of an insurer, you can easily look it up. It's part of a carrier's annual report and it is available by line of business and by state.

Paul Buse is principal, founder and owner of Real Insurance Solutions Consulting.

This Student of the Industry article is part of a monthly column on IAMagazine.com. Keep an eye on Thursday's weekly News & Views e-newsletter in June for the next off-beat take on current trends in the insurance industry.