Insolvency and errors & omissions risk go hand in hand and when claims aren't settled, insureds may turn to the agent for restitution. Here are four lessons from a real case.

Last month, we saw how insurer names can be almost identical and how issues, such as insolvency, can be problematic if you overlook the difference.

Insolvency and E&O risk go hand in hand. When claims are not settled because of insurer insolvency, insureds are naturally upset. Upset insureds may then turn to the agent that placed the risk with the now-insolvent insurer.

Of course, that does not mean the agent did anything wrong. Quite the contrary, the agent does not control the insurer's operations.

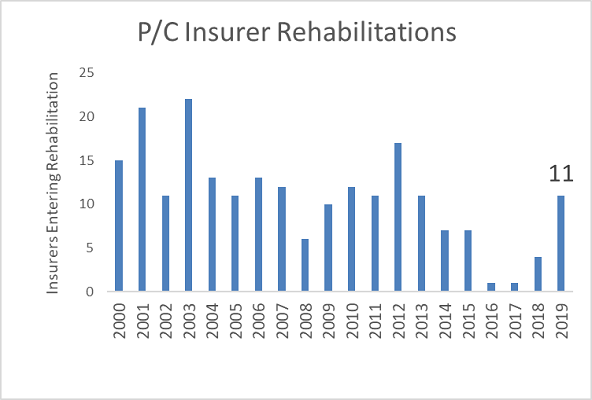

We'll look at an actual errors & omissions insolvency case involving one such insurer. But before we do that, below is a look at the increasing number of insurers facing insolvency in 2019, according to the Best's Special Report: 2019 US Property-Casualty Impairments Update by A.M. Best.  Source: Best's Special Report: 2019 US Property/Casualty Impairments Review. Accessed Nov. 5, 2020

Source: Best's Special Report: 2019 US Property/Casualty Impairments Review. Accessed Nov. 5, 2020

Now let's review that E&O case that involved insurer insolvency.

The defendants in the E&O case were an agency called Safe Harbor and several wholesalers who assisted in placing coverage for R&M Mixed Beverage Consultants of El Paso, Texas, in 2006 with an established and fairly large insurance company, First Mercury Insurance Company.

On the 2008 renewal, however, R&M requested a new quote and Safe Harbor obtained options from the same agent and wholesaler. R&M decided to move to Indemnity Insurance Corporation, a risk retention group.

Remember that name from last month's Student of the Industry? That's right, Indemnity Insurance Corporation has an amazingly similar name to Indemnity Insurance Company.

Indemnity Insurance Corporation grew from $2.7 million in premiums in 2013 to over $40 million in 2017, experienced a regulatory take-over, and ultimately went into liquidation with its owner and CEO currently serving 37 years in prison for fraud. Indemnity Insurance Company is a Chubb-affiliated insurer that is rated A++ with A.M. Best and has been writing over $1.2 billion in all commercial lines through independent agencies for some time.

In 2011, R&M—now insured with Indemnity Insurance Corporation and no longer with the established, larger insurer, First Mercury—experienced two loss events where patrons of R&M establishments were allegedly over-served alcohol and accidents occurred. Indemnity Insurance Corporation began defense proceedings for R&M and hired legal counsel.

But before the full resolution of either case, Indemnity Insurance stopped making defense payments due to its impairment and then liquidation. As coverage was with a risk retention group, no guaranty fund protection existed.

R&M sued Safe Harbor and the wholesalers. Safe Harbor was absolved of any responsibility for damages as were the wholesalers involved. While the case was then appealed, a three-judge panel of the Eighth District of Texas Court of Appeals ruled strongly in favor of the agent and wholesalers.

Here are four things we learned from this case:

1) E&O risks are real from an insolvency situation. Agents should assume an A-rated company can become F-rated quickly and prepare accordingly. These are more likely to arise in specialty or unusual placement situations like this one.

2) Get help when you need it. Use knowledgeable wholesalers if placing a specialty risk. In this particular case, it's clear the wholesalers appear to have assisted in several instances in proper documentation and product knowledge.

Does your wholesaler, managing general agency, or managing general underwriter provide product knowledge? Do they provide risk-specific checklists? Can they assist you in benchmarking the limits for the risk? Do they offer help with regulations on declinations and considerations with respect to guaranty fund cover?

3) Documentation is your friend. When coverage was placed, notice was provided to R&M about the unusual choice of insurer. Specifically, an acknowledgment was signed by R&M stating it recognized their choice was for a "non-traditional market" and that no guaranty fund coverage applied, and also that a risk retention group is not protected by state guaranty funds.

The acknowledgment even included a hold-harmless with respect to “any future loss, damage, expense, or other financial risk and any other dispute that may arise relative" to its placement of coverage with Indemnity Insurance Corporation.

4) Claims happen. Even seemingly unreasonable claims cost time and money to defend. In retrospect, the agent and wholesalers did a very good job—but it didn't prevent them from being sued.

The most important part of your E&O coverage is not its cost, it's how effectively your insurer defends you.

Of all the lessons learned from this case, it's that documentation carried the day for this agency.

Paul Buse is operations and strategic advisor, Big I Advantage®

If you have an insight or topic you are interested in looking into, email me. Keep an eye on Thursday's weekly News & Views e-newsletter in December for the next off-beat take on current trends in the insurance industry.