Directors & officers insurance certainly has been in the press recently—boards of directors are concerned over price increases and lawsuits related to COVID-19.

Directors & officers insurance certainly has been in the insurance trade press recently—mainly discussions of price increases and profitability but, outside our fair industry, boards of directors are concerned over price increases and their exposure to lawsuits related to COVID-19.

Recently, onlookers saw what looked like an extraordinary event in one company's D&O risk due to their CEO’s activity in the Twittersphere.

Let's start with the basics so you'll be better armed with information to keep watch over developments in D&O insurance in the coming months.

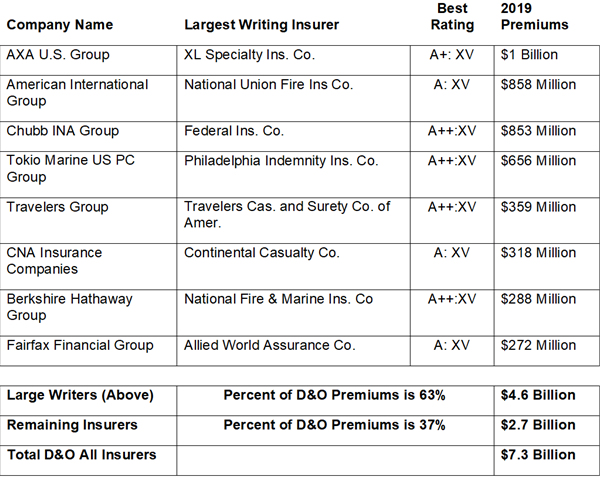

Who writes D&O insurance? The industry is serviced by a relatively small number of players. In fact, out of almost 3,000 P&C insurers, there were only 196 policy-issuing D&O insurers in 2019. Of those, 178 are part of just 51 company groups and 18 are unaffiliated with any group.

A good example of the former is National Union, which belongs to American International Group (AIG). An example of the latter is the unaffiliated insurer ICI Mutual, a large risk retention group that serves the mutual fund industry.

When you look deeper, you quickly realize that even the relatively small sub-group of D&O insurers is then even more concentrated. Of the 51 groups and 18 unaffiliated insurers, just eight groups or fleets write the vast majority of premiums. In 2019, that select group of big premium writers wrote 63% of all D&O premiums.

Who are they? The groups are listed below. As the group or fleet name is sometimes less recognizable, also provided is the name of the groups largest policy-issuing insurer in professional liability. The group is made up of any insurer that wrote more than $250 million in D&O premiums. For perspective, $250 million is about the premiums for a typical medium-to-small, multiple-line, multiple-state insurer.

Now you know the premiums, what's happening with them?

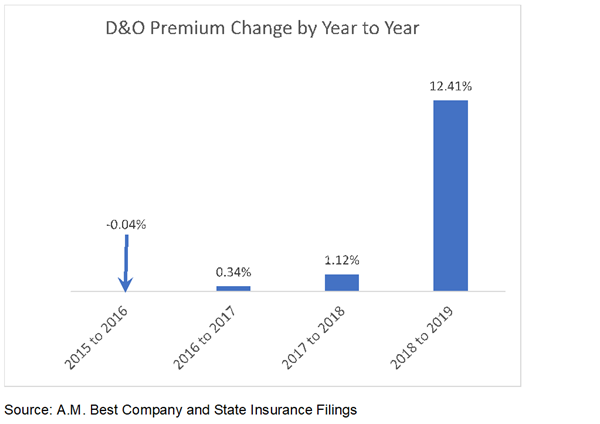

In short, they are increasing. The data for 2019 is now available, and as you can see below, after three years of very flat overall D&O premiums, premiums have shot up by almost 12.5% from 2018 to 2019.

Many in the industry are discussing increases that are much bigger than that. Buyers are concerned, insurers are concerned and loss ratios are increasing on this line. And then we have the uncertain impact of COVID-19 yet to come.

An interesting development to watch in D&O insurance: Recently, Elon Musk sent out a tweet that said very directly that the Tesla, Inc. stock price was "too high." This resulted in a substantial fall off in the price of Tesla stock.

Many shareholders were upset and vocal about that on Twitter, and many immediately wondered if that was a major liability risk for Tesla and its board of directors. Adding to the intrigue, just a few weeks before, it was publicized that the Tesla board had elected to "self-insure" their D&O exposure and the board would trade their protection from insurers—like those listed above—for what is described as a "substantially equivalent" personal indemnification agreement from Musk.

I honestly don't know what to think but my gut reaction on hearing the news resulted in the below cartoon.

This Student of the Industry article is part of a new monthly column exclusively on IAMagazine.com. Keep an eye on Thursday’s weekly News & Views e-newsletter in June for the next off-beat take on current trends in the insurance industry.

Paul Buse is operations and strategic advisor, Big I Advantage®.