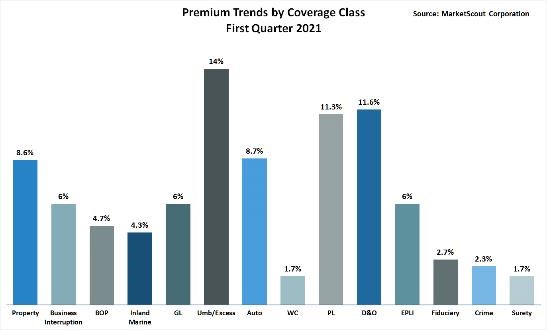

Rates continued their upward climb in the first quarter of 2021, with significant increases in umbrella liability, directors & officers and professional liability.

First-quarter 2021 property-casualty results are in and rates continue their upward climb with the largest increases by line of coverage in umbrella liability with a 14% increase, directors & officers with a 11.6% increase and professional liability with a 11.3% increase.

Significant increases were also seen in commercial auto and commercial property, both increasing 8.7% and 8.6% respectively.

“We expect rate increases to continue for the remainder of 2021," said Richard Kerr, CEO at MarketScout.

By industry group, transportation has suffered the largest account increase with an 11.7% rise, impacted by an increase in energy rates of 6.3%. Additionally, the habitational account suffered a 9.3% increase in the first quarter.

“Because the property market is so large, the composite rate is tempered by placements across the U.S.," Kerr said. “In CAT-prone areas, rates were up significantly more than the composite rate of 8.6%."

A summary of the first-quarter 2021 rates by coverage class is below:

| By Coverage Class |

|

| Commercial Property | Up 8.6%

|

| Business Interruption | Up 6%

|

BOP

| Up 4.7% |

| Inland Marine | Up 4.3% |

| General Liability | Up 6% |

| Umbrella/Excess | Up 14% |

| Commercial Auto | Up 8.7% |

| Workers Compensation | Up 1.7%

|

| Professional Liability | Up 11.3% |

| D&O Liability | Up 11.6% |

| EPLI | Up 6% |

| Fiduciary | Up 2.7% |

| Crime | Up 2.3% |

Surety

| Up 1.7%

|

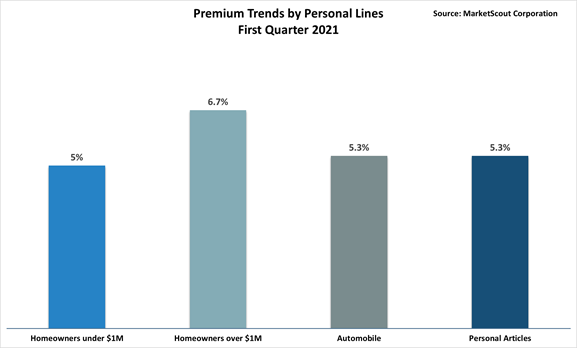

On a more positive note, U.S. composite rates moderated in the first quarter of 2021 with a 5.6% increase compared to a 6.3% increase in the last quarter of 2020. Auto and personal article rates were down in the first quarter; however, catastrophe-prone areas such as Florida will be hit with the largest increases.

“While rates moderated slightly, the market continues to harden for homeowners in Florida and California," Kerr said. “Insurers are cutting back and homeowners are paying the price. If you own a CAT-exposed home in Florida or in a wildfire-prone area in California, the rate increases can be as much as 25 to 30%."

A summary of the first-quarter 2021 personal lines rates is below.

| Personal Lines |

|

Homeowners under $1,000,000 value

| Up 5%

|

| Homeowners over $1,000,000 value | Up 6.7%

|

| Automobile | Up 5.3%

|

| Personal Articles | Up 5.3%

|

MarketScout is a national MGA and wholesale broker specializing in assisting agents in placing high net worth personal lines business.