Why Some Banks Are Divesting Their Insurance Brokerage Operations—And Some Aren’t

By: Mark Crites

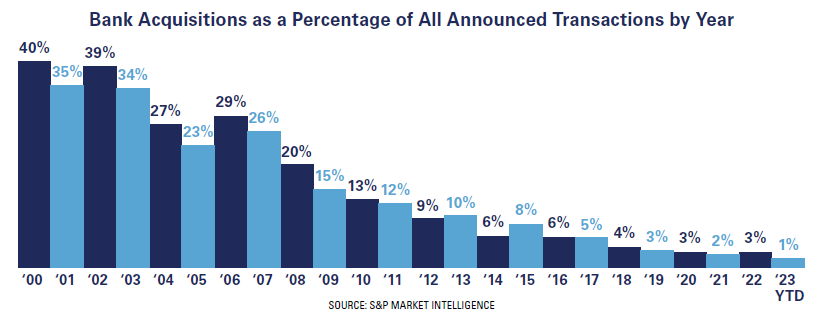

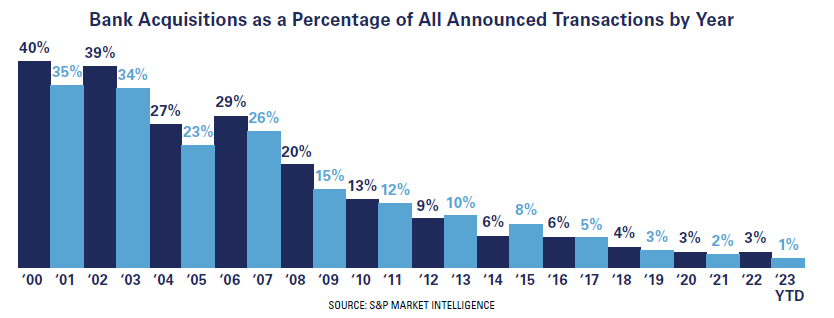

Banks have been a key part of the insurance brokerage industry since the early 2000s. After the passage of the Gramm-Leach-Bliley Act (GLBA) in 1999, which permitted banks to enter other industries, including insurance, acquisition activity took off.

Pairing banks and insurance brokers makes sense because the same commercial and retail clients can be offered complementary banking and insurance services in one sale. Also, multiple products and touchpoints strengthen relationships, and brokers produce recurring non-interest income that helps offset cyclical bank revenues.

While banks came out swinging in the early 2000s—completing over 20% of the total announced deals from 2000 to 2008—the share of M&A activity for banks dropped after the Great Recession and hit an all-time low this year. While banks have been a mainstay in insurance for over two decades, recent activity demonstrates a major strategic shift for financial institutions nationwide.

In the last two years, several large bank-owned insurance brokers have sold strategic competitors. But what is driving these bank divestitures? Here are a few of the primary reasons:

Capitalize on all-time high market valuations for insurance brokers. As widely publicized, valuations for insurance brokers continue to be at all-time highs, driven by strong public broker valuations, a plethora of active buyers and strong underlying industry performance.

Right-size the bank’s balance sheet in a high-interest rate environment. The quick climb in interest rates over the last 18 months has turned some bank balance sheets upside down. Selling a bank’s insurance operations can restore healthy balance sheet ratios and provide capital for other investments.

Provide additional resources that are available at larger platforms. The investment required in tools and resources to improve the client experience and effectively compete in the middle market has changed drastically over the last decade. There is an arms race in the insurance brokerage space and those not willing to invest in technology and additional client resources may be left behind.

Cross-selling did not always pan out. While the customer is the same for banks and insurance brokers, the sale process looks very different. Further, properly incentivizing both the commercial lender and the insurance producer can be challenging, and many banks never cracked the code.

So, is this the end of banks in insurance? Absolutely not. Even after recent divestiture activity, several banks are electing to retain their insurance brokerage platforms. Here are a few reasons why:

Customer overlap. While cross-selling has been a struggle for some, there is still customer overlap between banks and insurance. Being a one-stop shop is attractive for many customers.

Non-interest income. Insurance brokers produce recurring fee income for banks that can provide stability amid interest rate fluctuations. For many firms, insurance income represents a majority of a bank’s total non-interest income.

Broker fundamentals. Broker performance has been outstanding over the last several years with firms hitting all-time high organic growth and profitability results in each of 2021, 2022 and 2023, according to Reagan Consulting’s “Growth & Profitability Survey.” While the industry is in the midst of a rising rate environment, which has propelled growth, brokers have fared well, even during tougher economic conditions, such as the pandemic.

While there will likely be more bank divestures to come during a strong valuation environment, banks will continue to remain relevant in the insurance industry. Those that choose to remain in the business will need to continue to invest in tools and resources to equip their leaders to be successful in today’s competitive environment.

Mark Crites is a partner at Reagan Consulting.