Traditional, non-guaranteed universal life insurance, also known as current assumption universal life, has been subjected to rather brutal criticism over the last few years.

Most recently, a Wall Street Journal article blamed the product for financial hardship experienced late in life by many policy owners who purchased these policies in the 1980s-1990s.

But how much of this condemnation is truly warranted, and how much of it reflects a fundamental misunderstanding of how these products are designed to work when properly tended to?

How It Works

Current assumption universal life is a flexible premium permanent life insurance product that contains both an insurance component and an investment component. Like other permanent life insurance products, premiums are deposited in the policy’s cash account, which is reduced by policy charges and increased by a crediting methodology set forth under the terms of the policy.

But what differentiates a current assumption universal life policy from other types of non-guaranteed permanent life insurance is that the growth of the policy’s cash value is based on a flat crediting rate established by the insurance carrier and adjusted from time to time.

Projections of current assumption universal life policy performance are based on forecasting two variables: annual policy charges, and the insurance company’s crediting rate. While many life insurance policies allow the insurance carrier to increase policy charges under specified circumstances, this discretion is very rarely exercised and annual policy charges rarely deviate from schedule set forth at the time a policy is issued.

By contrast, the crediting rate on current assumption universal life policies, which is tied to the interest rate the insurance carrier is able to earn on its portfolio of fixed income investments, changes regularly. For those whose current assumption universal life policies have been dramatically underperforming, the primary source of the problem is that nobody has been monitoring the crediting rate changes and adjusting annual premiums accordingly.

Understanding Policy Illustrations

When a current assumption universal life policy is issued, an illustration is run to project how the policy will perform under the assumption that scheduled policy charges will not change and the crediting rate at issuance remains constant. It’s an imperfect system, but without the benefit of a crystal ball to accurately predict interest rate changes, it’s at least a good place to start.

It’s also important to recognize that the amount that the beneficiary receives under most permanent life insurance products is a level death benefit that doesn’t vary based on the cash value of the policy. What that means is that as the policy builds cash value, the amount of pure life insurance protection that needs to be purchased to produce the policy’s death benefit gets smaller—reducing policy charges and accelerating the buildup of policy cash value.

As a general rule, current assumption universal life illustrations are intentionally designed to calculate the minimum annual premium necessary to keep the policy in force indefinitely. This approach to policy design is a big part of what differentiates universal life insurance from the primary alternative in the permanent life insurance arena—whole life.

Whole life policies operate somewhat like a “sinking fund,” with noticeably higher premiums that result in greater cash value, but also reduce the policy’s economic yield. Meanwhile, universal life policies are typically structured to be cost-efficient and maximize the rate of return on each dollar of premium.

The theory behind minimally funding current assumption universal life policies is that every additional dollar that doesn’t have to be used to pay premiums is money the insured’s heirs will receive in addition to the policy’s death benefit. While this approach may seem risky given the uncertainty surrounding future crediting rate changes, it actually works quite well as long as policyholders and their insurance advisers actively monitor policy performance and adjust premium levels whenever there is a change in crediting rates.

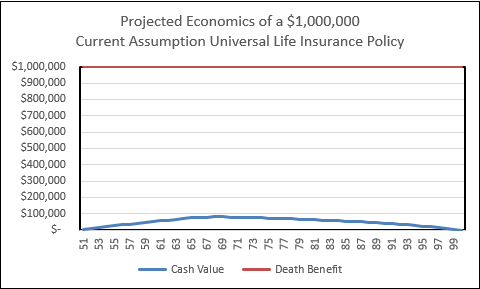

Consider this example: A 50-year-old man in preferred health purchases a $1-million current assumption universal life policy for an annual premium of $8,808 per year, based on the insurance carrier’s current crediting rate of 3.9%. If the crediting rate stays constant at 3.9%, with no changes in scheduled policy charges, the policy’s cash value will gradually rise to a peak value of just under $79,000 at age 70, then gradually diminish each year until falling to only $9 of cash value at age 100:

But what happens when the crediting rate rises or falls?

But what happens when the crediting rate rises or falls?

If the crediting rate falls, absent a premium adjustment, the policy cash value will build more slowly, peak sooner than age 70 and drop to zero before the insured reaches age 100, causing the policy to lapse. If the crediting rate rises, absent an adjustment of premium, the policy cash value will build more rapidly and peak later than age 70—and, depending on the magnitude of the rate increase, it’s possible that the cash value may never peak at all and could continue to gradually rise indefinitely.

While having excess cash value may seem better than watching the policy run out of money and lapse, continuing to pay the same level premium into a policy that’s outperforming expectations is less economically efficient and will ultimately result in a smaller payout because those extra premium dollars will not increase the policy’s death benefit.

Managing Policies Effectively

The real lesson here is that current assumption universal life policies require constant monitoring and periodic adjustment to provide a cost-efficient death benefit and maximize the return on premium. Modifying the premium whenever the crediting rate changes will keep policies operating at peak efficiency, while also avoiding nightmare scenarios where policies become so dramatically underfunded that policyholders can no longer afford to get them back on track once they finally recognize there’s a problem.

Additionally, conducting a thorough suitability analysis ensures that policyholders will still have the financial ability to maintain their policies in adverse crediting rate environments. Never sell a minimally funded current assumption universal life policy that already requires the maximum premium a client can afford.

Is there a way to salvage a current assumption universal life policy that is underperforming because it has been neglected? It depends on the degree of underfunding and how much additional cash the policyowner is willing and able to commit to reviving the policy.

However, it’s possible that reviving the policy no longer makes economic sense, even if the policyowner can afford to do so. For someone in this situation, the best approach is to have an experienced, independent insurance professional review the policy to determine what options are available. Paying additional premiums is one possible solution, but it may also make sense to consider alternatives such as reducing the death benefit, exchanging the policy for a different product, or selling the policy in a life settlement.

Poorly performing current assumption universal life products such as those purchased in the 1980s-1990s should reflect poorly on not the underlying insurance product, but rather the insurance adviser who failed to properly explain the product and ensure adequate maintenance in the future.

Jordan Smith is vice president of advanced design at Schechter, a third-generation boutique financial services firm in Birmingham, Michigan.