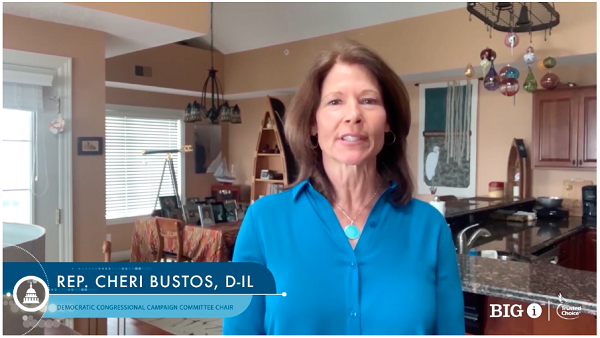

Rep. Cheri Bustos (D-Illinois) reinforced the important role that independent insurance agents and brokers must play in the coronavirus pandemic.

Today, during the 2020 Big “I” Virtual Legislative Conference, Rep. Cheri Bustos (D-Illinois) reminded viewers of the important role that independent insurance agents and brokers must play in the coronavirus pandemic.

“As insurance agents, you’re there for our nation at the worst of times,” said Rep. Bustos (pictured left). “It is my hope that we can continue to work together to bring our country through to the best of times.”

With small businesses—including many of the more than 20,000 Big “I” member agencies—across the nation hit hard by the coronavirus pandemic, Rep. Bustos described her ongoing efforts listening to small business owners, including hosting webinars to hear from those in the congressional district she serves.

“What I’ve heard is that you need the tools to keep your foundation strong: expanded unemployment benefits to help independent contractors and the self-employed, payroll assistance to help small businesses keep going as we get through this together, grants to help keep the doors open, low interest and forgivable loans that can help keep your businesses afloat in uncertain financial times,” Rep. Bustos said. “And while the solutions haven’t been perfect, we’ve been hard at work to dramatically expand these tools to help our small business owners.”

The bipartisan Coronavirus Aid, Relief and Economic Security (CARES) Act was “the most significant relief package in American history,” Rep. Bustos said, providing funding—that was soon after increased with bipartisan support—to fight COVID-19, keep businesses open and Americans employed.

Rep. Bustos emphasized the important role of independent insurance agents during the coronavirus crisis before highlighting legislative priorities that she continues to work with the Big “I” to address, including flood and crop insurance.

“You’ve been crucial in helping America’s families weather the storm,” she said. “From helping to arrange car insurance cost reductions to accommodate people who are driving less, to navigating life insurance benefits for the grieving families who have lost a loved one due to the pandemic, to helping our working families who need to rely on workers compensation, there’s a reason that our insurance providers are essential workers.”

“As the representative of the district that boasts 9,600 family farms, I know firsthand how challenging the growing season has been and that many of our farms across the country have faced flooding issues,” she said. “I was proud to cosponsor the ‘Flood Insurance Market Parity and Modernization Act,’ and I look forward to continuing our work together on this issue.”

The Big “I” also supported the Flood Insurance Market Parity and Modernization Act, which provides private flood insurance alternatives complimentary to the National Flood Insurance Program (NFIP) while clarifying important safeguard for consumers. Thanks to dedicated Big “I” lobbying, funding for the National Flood Insurance Program (NFIP) was extended days before the deadline at the end of December 2019 through September later this year. The Big “I” continues to advocate for a multi-year reauthorization of the NFIP that will modernize the program.

“As chair of the bipartisan Crop Insurance Caucus, I’ve been proud to support the delivery of crop insurance which is vital for many of the farms that I represent. This year, I’ve also cosponsored the Feed Emergency Enhancement During Disasters Act,” Bustos added. “We’ll work together with your organization and your members to deliver on these and other important insurance issues.”

AnneMarie McPherson is IA news editor.