The annual composite rate for both commercial and personal property-casualty lines continued to increase in 2021.

The annual composite rate for commercial property-casualty lines increased for the fifth year in a row, up from 5.6% in 2020 to 6.6% in 2021, according to MarketScout. Meanwhile, the personal lines composite rate continued its rise, increasing from 4.2% in 2020 to 4.9% in 2021, marking the tenth consecutive year of rate increases.

The fourth quarter saw the p-c composite rate increase to 5.8%, down from 6.8% for the third quarter of 2021. Large increases were seen in the umbrella and excess line of business, which saw an increase of 11%. Commercial property increased by 8.3%, while directors & officers liability increased 10.3%.

When compared to the third quarter of 2021, every line of coverage except business owners policies had the same or a lower increase in the fourth quarter.

“The fourth quarter 2021 reflects moderation in rate increases," said Richard Kerr, CEO of MarketScout. “However, when comparing rates for the entirety of 2021, rates did increase from plus 5.6% in 2020 to plus 6.6% in 2021."

Below is a table containing market data of fourth quarter commercial rate increases.

Commercial property

| Up 8.3%

|

Business interruption

| Up 6%

|

Business owners policy

| Up 5.3%

|

Inland marine

| Up 4.3%

|

General liability

| Up 5.3%

|

Umbrella and excess

| Up 11%

|

Commercial auto

| Up 6.7%

|

Workers compensation

| Up 0%

|

Professional liability

| Up 6.3%

|

D&O liability

| Up 10.3%

|

Employment practices liability

| Up 8%

|

Fiduciary

| Up 1.7%

|

Crime

| Up 1.3%

|

Surety

| Up 1.3%

|

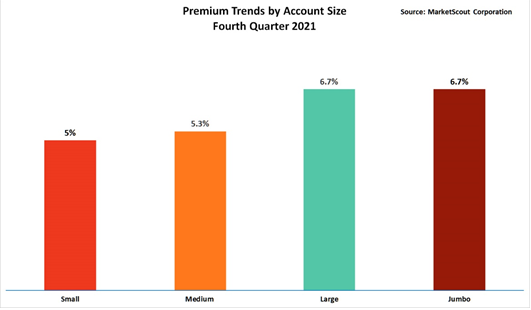

Additionally, rates moderated for all account sizes, with medium sized accounts—$25,000 premium to $250,000 premium—moderating the most at 5.3% in the fourth quarter, down from 7.3% in the third quarter.

On the personal lines side, MarketScout reported that rates increased 4.25% in the fourth quarter of 2021. However, homeowners, personal articles and auto rates all moderated slightly from the third quarter.

“The composite national personal lines market continues to steadily adjust rates as necessary without year over year massive rate increases. However, for CAT-exposed properties, rate increases can be dramatic; as much as 25% to 40% in areas such as the wildfire corridors of California or southern portions of Florida," Kerr says.

Below is a table containing market data of fourth quarter personal line rate increases.

Homeowners under $1,000,000 in value

| Up 3.7%

|

| Homeowners over $1,000,000 in value | Up 6.3%

|

| Automobile | Up 4% |

| Personal articles | Up 3%

|

MarketScout is a national managing general agent and wholesale broker specializing in assisting agents in placing high net-worth personal lines business.