The fourth quarter of 2020 saw the composite rate for personal lines increase 6.3%, reflecting the market's rate acceleration.

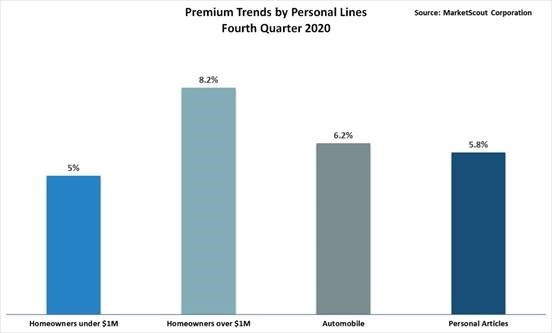

The composite rate for personal lines was up 6.3% in the fourth quarter of 2020, reflecting the market's rate acceleration. In fact, homeowners with properties valued over $1,000,000 paid average rate increases of 8.2%, clearly signaling ongoing price increases for large homes.

“Rates are up modestly across all sectors of personal insurance with high net worth homeowners rates up the most," says Richard Kerr, CEO of MarketScout. “Wealthy clients are buying more homes as an escape and if they are not buying something new, they are renovating the ones they already own. Homeowners lucky enough to own properties with the home replacement cost in excess of $1 million have borne the brunt of most of the rate increases, especially in the fourth quarter of 2020."

“For those homeowners fortunate enough to own a beach or mountain home, increases are more severe," Kerr adds. “Homes in brush fire areas of California or hurricane-prone sections of Florida are assessed rate increases as high as 20-30%. The only way to offset big rate increases is to shop your insurance and limit coverage or raise deductibles."

The National Alliance for Insurance Education and Research conducted pricing surveys used in MarketScout's analysis of market conditions. These surveys help to further corroborate MarketScout's actual findings, mathematically driven by new and renewal placements across the United States.

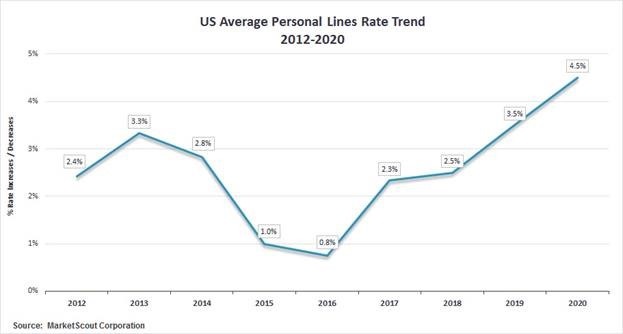

A summary of annual personal lines average rate increases from 2012 to 2020 is below.

A summary of the fourth quarter 2020 personal lines rate changes is set out below.

Personal Lines

|

|

Homeowners under $1 million value

| Up 5%

|

Homeowners over $1 million value

| Up 8.2%

|

Automobile

| Up 6.2%

|

Personal Articles

| Up 5.8%

|

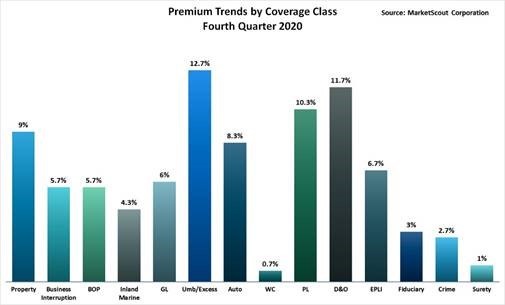

Property-casualty rates also continued an upward trend. Despite 2020 being one of the strangest years in recent history, the insurance industry continued to function efficiently. The fourth quarter 2020 composite rate was up 7.1% as compared to 6.25% for the third quarter of 2020.

The biggest rate increases by line of coverage were for umbrella liability, professional lines and directors & officers liability. Rates increased for all sizes of businesses and industries except for public entities and energy companies.

“Rate increases are continuing," Kerr says. “We believe the slight moderation in energy rates in the fourth quarter 2020 is an anomaly based on the considerable reduction in exposures in the oil and gas sector. Rates for public entities were also relatively modest."

In reviewing the results for 2020 overall, the composite rate increase was 5.6%. “Composite rates for property-casualty insurance have traded in a relatively tight corridor the last ten years as compared to the ten-year period of 2001 to 2010 when rate swings were considerably more volatile," Kerr says. “Improved underwriting tools, catastrophe modeling and more thoughtful reinsurance placements have taken most of the severe peaks and valleys out of the market. Simply stated, underwriters are smarter than they were 15 years ago. The exceptional underwriting and technology tools help make for a more stable market."

A summary of the fourth quarter 2020 rates by coverage class is set forth below:

By Coverage Class

| |

Commercial Property

| Up 9%

|

Business Interruption

| Up 5.7%

|

BOP

| Up 5.7%

|

Inland Marine

| Up 4.3%

|

General Liability

| Up 6%

|

Umbrella/Excess

| Up 12.7%

|

Commercial Auto

| Up 8.3%

|

Workers' Compensation

| Up 0.7%

|

Professional Liability

| Up 10.3%

|

D&O Liability

| Up 11.7%

|

EPLI

| Up 6.7%

|

Fiduciary

| Up 3%

|

Crime

| Up 2.7%

|

Surety

| Up 1%

|

MarketScout is a national MGA and wholesale broker specializing in assisting agents in placing high net worth personal lines business.