IVANS is revolutionizing the commercial lines policy workflow, creating a more connected and efficient ecosystem for all stakeholders. The goal: A superhighway, connecting insurers, agencies and insureds in a single exchange.

The commercial lines policy workflow is historically riddled with inefficiencies. From searching for markets to data capture, from submission to the insurer to receiving the bound policy, these manual processes cost agencies and insurers time and money.

Agents and insurers must take advantage of the technology available to streamline these inefficient workflows because, ultimately, their business is at stake.

Large, digital businesses like Amazon and Apple have redefined customer experiences, creating a demand for instantaneous and digitally collaborative capabilities. While technology adoption has exponentially accelerated recently, there are still critical processes that have not been automated.

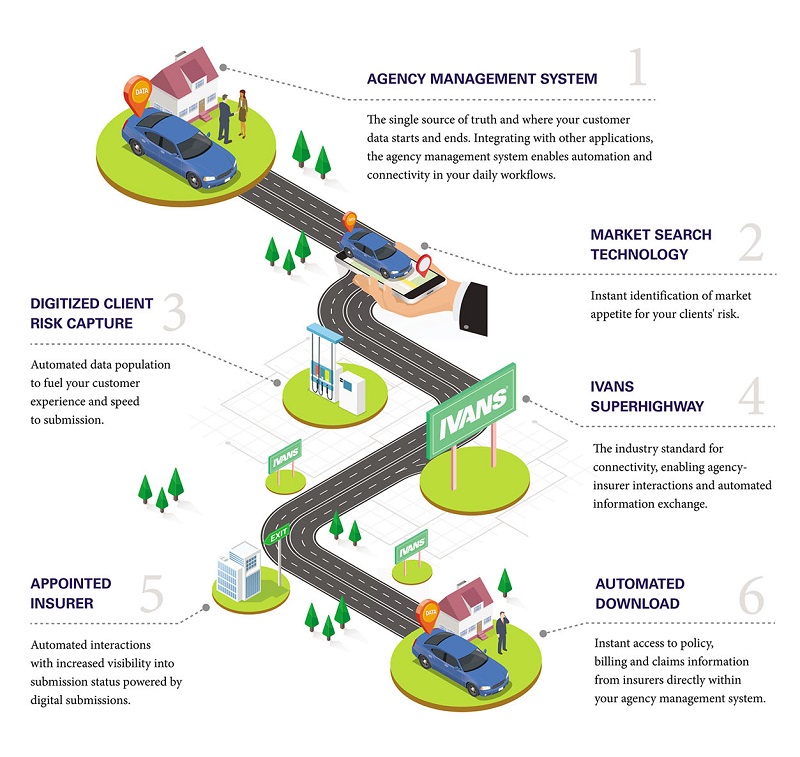

IVANS is revolutionizing the commercial lines policy workflow, creating a more connected and efficient ecosystem for all stakeholders. The goal: a superhighway, connecting insurers, agencies and insureds in a single exchange. Let's cruise and see how the road looks.

1) The Necessary Tools to Drive

The transformation journey begins where most of the agents' work takes place—the agency management system or, in this analogy, the agent's home.

The house has all the capabilities needed to complete the commercial lines policy lifecycle, including market search technology and the open architecture to connect to data capture and submissions solutions. Agents must have this foundational digital technology to truly digitize the commercial lines process.

Next to the house and ready to get on the superhighway is the agent's car. The car represents the customer data as it begins its journey down the superhighway.

Let's say a prospect needs commercial insurance for a retail boutique. The potential client provides a few personal details, the size and location of the business, and the journey down the superhighway is ready to begin—almost.

2) The GPS of Commercial Lines Insurance

The next step is where the friction begins for many agents. As soon as the agent receives the first round of information from the prospect, the agent must find a market for that specific risk.

Many agents have a few insurers that they traditionally contact for quotes. However, those insurers may not quote all the risks an agent needs, which ultimately puts the agent at risk of losing the potential client. In fact, nearly 70% of agencies said they often lose opportunities because they cannot find a market to quote the risks, according to the 2020 IVANS Agency-Insurer Connectivity Report.

But with the GPS that comes with the superhighway—or in non-superhighway terms, market search technology—the agent can find an insurer along the superhighway with the appetite for the prospect's risk.

The agent types in the line of business for the commercial risk and size of the business. The agent finds an insurer they're already appointed with on the GPS and selects that destination. And now the car can begin its journey down the highway.

3) The Fuel for Customer Interactions

3) The Fuel for Customer Interactions

One of the longest processes in the entire commercial lines policy lifecycle is data collection between agents and their customers or prospects.

Many commercial risks require insureds to fill out multiple forms, oftentimes with the same information across each form. Requiring the customer or prospect to fill out so many forms invites unnecessary opportunities for errors and omissions, not to mention the poor customer experience.

The poor customer experience and inefficient use of time continue as the agent follows up to capture any missing information. Fifty percent of agencies with books of business in small, middle-market and enterprise accounts said agency staff spend at least one to five hours per week chasing down their clients to collect information, according to Indio's State of Insurance Renewals report.

To streamline this process and enable the agent and passenger to drive down the superhighway with speed, they need a digital data capture solution to fuel the car.

The fuel enables the agent to digitize the application and supplemental forms and automate data population across multiple insurer applications. By delivering a collaborative and digital experience for customers to provide information and then auto-map the data across multiple forms, agents reduce duplicate data entry for their staff and customers.

Not only will the agent save time, but the digital system will reduce errors and omissions in applications, creating a better experience for all stakeholders.

4) The Agent-Insurer Superhighway

Once the prospect has filled out the applications and the agent has worked with the prospect to ensure all submission components are prepared, the next step is for the agent to submit everything to the insurer for a quote.

In the inefficient, traditional method, agents either send the bulk of PDF forms to the insurer via email or rekey information into the insurer's portal. Each option creates traffic delays and bumps in the road.

When the agent must submit the forms to the insurer via email, the work is on the insurer to manually rekey information from the PDF into their system. Conversely, if submitting via the insurer's portal, the agent must spend time rekeying the information. In either situation, insurers risk errors in the application as prospects and agents manually fill out these forms. This requires the insurer to reach out to the agent for additional information, slowing the process even more. Given that an average of 38% of commercial submissions are declined, according to the 2020 IVANS Agency-Insurer Connectivity report, too much time is wasted performing these manual, administrative tasks.

Agents using the superhighway to automate these interactions with their insurer partners will greatly decrease the amount of time spent submitting commercial risks.

Thanks to its open architecture, IVANS' distribution partners—including agency management systems, data capture solutions and other InsurTechs—are joining the superhighway, creating distribution connectivity (exits) for independent agencies.

Furthermore, insurers are implementing application programming interfaces that send the data collected by data capture solutions directly to their policy administration and underwriting systems. This eliminates the need to prepare the documents before sending them to the insurer or the need to rekey the information into the insurer portal.

5) Greater Driving Visibility

After the agent has sent the submission to the insurer, they have no visibility of the status of the submission. Any information gathered is reactive, as the agent must reach out to the insurer when a customer wants to know the status of the policy.

In today's age of instant information, agents who are not responsive risk losing business, making greater visibility into submission status a necessity.

The IVANS superhighway can remedy this challenge between brokers and insurers. While the superhighway works one way to submit the information via application programming interface to the insurer, it also works the opposite way to provide the agent with information on the status of their submission.

The ultimate goal? Provide automatic updates from the policy administration system to the AMS as the submission makes its way through the underwriting process.

6) The Journey Back Home

The agent has brought the passenger through the commercial lines policy lifecycle all the way back home. They conduct daily workflows in the AMS and receive an automated notification that they can now access the customer's bound policy. The agent checks that the download includes the e-documents and policy information and then notifies the customer that the policy information is ready to access in the online self-service portal.

This last step of the commercial lines submissions journey is one that, arguably, has digitally transformed the most. Many agents and insurers have adopted download technology and are regularly using it. Usage of document and message downloads by agencies is high, at approximately 69%.

Insurer adoption is also climbing, with 65% of insurers reporting that they send documents and messages directly to agency partners' management systems—a 19% increase year over year, according to the latest IVANS Agency-Insurer Connectivity report.

While these adoption rates have increased, many agents and insurers still have yet to adopt the downloading process. Using methods such as snail mail and fax to transport policy documents creates manual, administrative tasks for insurers and agents while also lengthening the time it takes to get the bound policy into the customer's hands.

As more agents and insurers adopt download technology and enable a seamless exchange of information and documents from the insurer's policy administrative system to the AMS, all stakeholders stand to win.

Insurers save time and money by digitally sending this information rather than physically handling and mailing it. Agents also gain efficiency by receiving this information electronically, eliminating the need to follow up with their insurer partner and waiting on information. According to the IVANS connectivity report, agents save approximately two hours per employee per day by using automated information exchange technologies like download.

We Are All on This Journey Together

While insurance has been slow to digitally transform, we are seeing more technology adoption than ever before. Independent agencies are realizing profitable growth through more seamless interactions with their insureds and insurer partners.

Agents looking to continue their growth through increased efficiencies should set their course toward technology enhancing the commercial lines policy lifecycle. Agencies and insurers have struggled with the manual nature of the process too long, losing business and wasting time. Now is the time to digitally transform this historically paper-laden part of the business.

At IVANS, we remain committed and acutely focused on creating new and revolutionizing existing highways that have connected agents, insurers and insureds. When the whole industry has access to information and automated workflows, everyone benefits by capitalizing on more business opportunities, increasing efficiency within their daily workflows, and continuously delivering the high level of service that today's customer demands.

Reid Holzworth is CEO of IVANS Insurance Solutions.