Advisers may be surprised to learn that once a client turns 65, traditional health insurance in the individual marketplace is no longer available. The reason: Medicare is intended to be the primary source of insurance coverage, with private carriers providing supplemental plans to fill in the coverage gaps.

As your clients approach age 65, make sure you address their health insurance exposures to help them avoid potential coverage gaps and penalties if they miss the initial Medicare enrollment period.

Who and When to Enroll

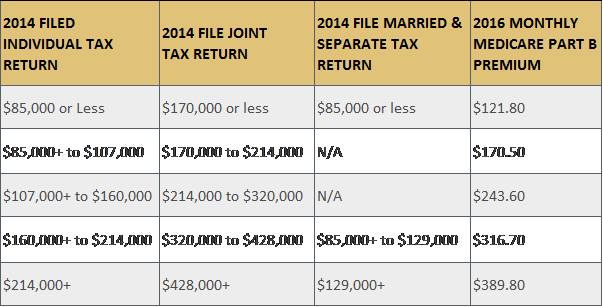

Medicare Part A covers hospital-related services. For clients or spouses who paid Medicare taxes while working, Medicare Part A is premium free. Medicare Part B covers physician-related services. The current monthly premium is related to a client’s taxable income as follows:

If a client is 65 and receives Social Security, they have likely been automatically enrolled for Medicare parts A and B. However, if a client continues to work, took early retirement and deferred receiving Social Security benefits, they likely need prompting to enroll in Medicare once they turn 65.

If a client no longer works and therefore has no coverage through a group health plan, nor has health insurance coverage through the group plan of a spouse who continues to work, enrolling in Medicare Parts A and B is imperative.

Enrollment in Medicare takes place during a seven-month period based on a client’s birthday: the “initial enrollment period.” The enrollment clock starts three months before the month a client turns 65, includes the month they turn 65 and ends three months after the month of their birthday. For example, if Bob turns 65 in June, his initial enrollment period begins in March and ends in September. As long as your client enrolls during the initial seven-month window, they avoid penalties and gaps in coverage.

Need to help a client sign up for Medicare? They can now do so easily online in just 10-30 minutes.

Late to the Party?

The consequences of missing the enrollment deadline are more than just financial.

Late enrollment penalty: If a client does not sign up for Part B when first eligible, a 10% penalty is assessed to the Medicare Part B premium for each 12-month period in which they were eligible for Part B but not enrolled.

For example, Bob’s initial enrollment period ended in September 2009, but he did not sign up for Part B until March 2012—which means a total of 30 months passed since the end of Bob’s initial enrollment period. In this scenario, a 10% penalty is assessed for each 12-month period without Medicare Part B coverage, so Bob must pay a 20% penalty on the amount of his Part B premium.

Keep in mind this penalty is not once and done. Bob will pay the 20% penalty on his premium for the entire time he carries Medicare Part B.

Coverage gaps: While the late enrollment penalty can be costly, a gap in coverage can be financially devastating.

If a client misses the initial Medicare enrollment period, the next opportunity to enroll is during Medicare’s general enrollment period, which lasts Jan. 1-March 31 each year. However, coverage does not begin until July 1.

Because insurance carriers do not offer individual health insurance coverage for those over the age of 65, a client will face a coverage gap if they don’t have coverage under a qualifying group health insurance plan, thereby self-insuring all medical claims until coverage commences.

Is there ever a time to delay Medicare Part B enrollment? Yes—in some scenarios, a delay in signing up for Part B is appropriate and would not include the risk of late penalties, such as:

- The client is still working and has coverage under a group health insurance plan from their employer, which has 20 or more employees.

- The client’s spouse is still working, and they have coverage under their spouse's group insurance plan through their employer, which has 20 or more employees.

In sum, to avoid the penalty and coverage gap pitfalls, a client or their spouse must meet two key conditions: They must be an active employee, and their employer must have 20 or more employees.

The COBRA Trap

Medicare does not consider COBRA and retiree coverage as a qualified group health insurance plan.

Once a client who is 65 and not enrolled in Medicare Part B loses an employer-sponsored health plan, they qualify for a special enrollment period, which gives them eight months to enroll in Part B. The special enrollment period clock starts on the earliest date of when your client loses company-sponsored health benefits, or on the last day of employment.

Unfortunately, many clients believe continuing health insurance through COBRA or retiree health insurance coverage is the same as having an employer-sponsored health insurance plan. It is not. Make sure you drive home the serious nature of getting this wrong.

Stacy Rush brings more than 18 years of experience in the property-casualty insurance industry to her role as a director at Pathstone Federal Street, an independent, integrated wealth management organization that provides multigenerational financial management and customized investment advisory.