As more millennials fill boomers' shoes, independent insurance agencies must change their hiring strategy—and the way they serve younger customers.

Everyone knows baby boomers are getting older. What some may not realize, however, is just how much the nation’s overall age demographics are shifting as a result.

What are the implications of an aging nation? First, future Social Security payments—and restoration of national debt—depend on future payroll and income taxes. The ratio of working adults to retirees continues to decrease, and some people question the viability of the way Social Security currently works.

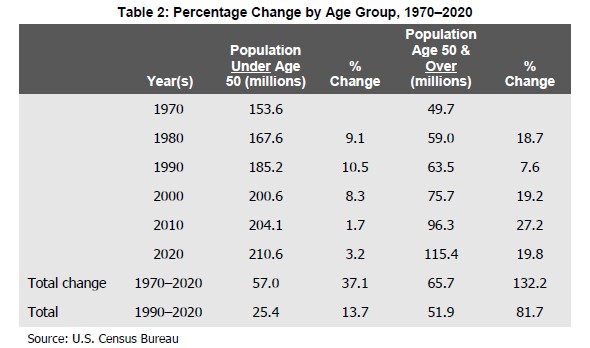

Second, while automation will continue to lower staffing needs in some industries, retiring baby boomers will leave holes for younger industry workers to fill. For example, 40% of management personnel in the insurance industry are expected to exit over the next 10 years. Notice in the chart below that the population over age 50 is projected to reach 115.4 million by 2020, while the percentage of the population under age 50 continues to drop.

Third, consumer spending constitutes about 70% of the gross domestic product, and spending patterns change as the population ages. For instance, retired individuals typically need one car instead of two—or sometimes none at all. Ridesharing and self-driving cars may render personal vehicles unnecessary altogether in metro and suburban areas.

Japan provides an interesting example of the impact of an aging nation. The country’s birthrate decline was steeper than the U.S., and a lower immigration rate led to reduced domestic consumption and a moribund economy. Further, Japan has fewer natural resources and hasn’t benefitted from the energy economy to the same extent as the U.S.

Many independent insurance agents in their 50s and 60s realize their personal and commercial lines clients fall into a similar generational cohort. In order for agencies to flourish in the future, attracting millennials is critical.

Most millennials prefer working for organizations that share their values and use technology to facilitate more convenient transactions. Independent agents need to know how to attract millennials—many of whom belong to an increasingly diverse U.S. population that continues to move away from traditional households.

The challenge for independent agents is twofold: Attracting young, talented employees to the agency and investing in them so the agency has vibrant workforce that helps the agency keep up with technological change; and ensuring that the agency expands its outreach to personal and commercial lines customers—including life, disability and related financial services lines of insurance—by increasing resources.

For example, does your agency use e-signature? Current and future clients and employees not only appreciate these types of services, but demand them. Now is a perfect time to revisit your agency’s strategy and tactics in regards to shifting demographics. Make sure your agency evolves alongside the population it serves.

Dave Evans is a certified financial planner and an IA contributor.