Approaching the subject of life insurance can sometimes be a challenge. Use these relevant questions to start the conversation with your clients.

If you’re not cross-selling life insurance to your personal and commercial lines clients, you’re missing out on a big opportunity.

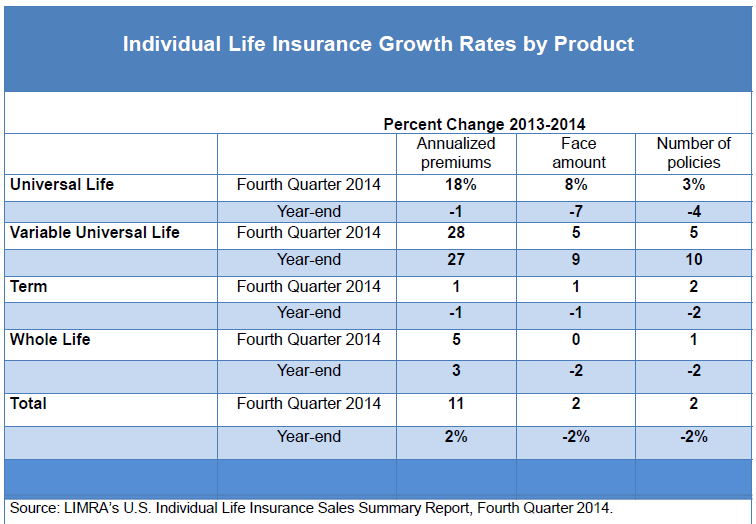

Getting appointed with a life insurance company is much easier than getting appointed to sell p-c insurance, and many MGAs assist agents in virtually every aspect of binding life cases—from term life insurance to buy-sell agreements and more involved estate planning cases. According to LIMRA, the growth rate remains significant for universal and variable life insurance.

An independent insurance agent may find it appropriate to raise the issue of life insurance at various life stages: a marriage or divorce, the birth of a child, the purchase of a house, a growing business and more.

But approaching the subject can sometimes be a challenge. The Insurance Information Institute has provided a list of relevant questions and rejoinders to start the conversation with your clients.

Does anyone depend on you for financial support?

Whether it’s a spouse, domestic partner, children, grandchildren or even aging parents, your clients want to make sure they leave their loved ones financially secure. Encourage them to buy enough life insurance to replace their income while also financing the expenses their beneficiaries will incur to replace services they provide within the household, such as landscaping or tax preparation. Stay-at-home parents and those caring full-time for an adult family member should also consider purchasing life insurance to cover the costs of hiring professionals to undertake these tasks.

Even if a client’s family has other sources of post-death income, such as Social Security benefits, it’s rarely enough—especially if they have children under the age of 18 and want to fund their education.

Are your retirement and other savings alone enough to support your dependents?

Unless a client’s savings and retirement benefits are substantial, the income they generate is unlikely to be enough to pay for the housing, education and other day-to-day needs of financial dependents. They will also have to take on the cost of replacing employer-provided benefits, such as health insurance premium payments and retirement contributions.

Will estate and inheritance taxes significantly reduce the amount your dependents receive?

Even if a client is leaving a considerable inheritance, don’t assume that will be enough. Consult with them regarding how tax situation impacts the type and amount of life insurance necessary.

What is your plan for covering final expenses?

Whether or not your client has dependents, they’ll want to be able to cover the expenses incurred by funeral related costs, outstanding taxes and debts and the administrative fees associated with “winding up” an estate. These expenses can total upwards of $15,000—a cost that the right life insurance policy could easily defray.

Will you be able to leave a donation to your favorite charity?

A beneficiary does not necessarily have to be a loved one; it can be a much-loved cause. If your client has a favorite charity, foundation or museum, they can use a life insurance vehicle to leave the organization a more sizable donation than they might have been capable of otherwise.

Your clients depend on you to help them deal with life’s perils. Don’t delay in reaching out to them about life insurance, or someone else will.

Dave Evans is a certified financial planner and an IA contributor.