New research suggests only 15% of women wait until their full retirement age to begin using their Social Security benefits—contradicting the trend of increasing life expectancies.

“Lies, damned lies, and statistics."

It’s a well-known adage, but sometimes disregarding statistics is a mistake—especially when they point to the need to educate people about their choices.

The perfect example? A statistic that is increasingly counterintuitive: According to a study sponsored by Nationwide Insurance, only 15% of women wait until their full retirement age to begin commencing their Social Security benefits.

This information contradicts the trend of increasing life expectancies. The Society of Actuaries finalized their revised actuarial tables in September, which now indicate that the average 65-year-old U.S. woman will live 88.8 years—up from 86.4 in 2000. Both men and women are enjoying meaningful gains in longevity, which means when people retire, they must consider the reality that they must fund a longer period of time for living expenses.

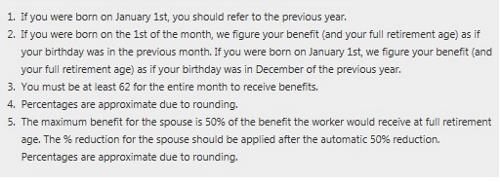

The general concept for Social Security is that someone receives benefits at their full retirement age (FRA). You can retire at any time between age 62 and full retirement age, but if you start benefits early, your benefits are reduced a fraction of a percent for each month before your full retirement age. The chart below lists age 62 reduction amounts and includes examples based on an estimated monthly benefit of $1,000 at full retirement age. Click on your year of birth to find out how much your benefit will be reduced if you retire between age 62 and full retirement age, noting also the earnings test for starting benefits prior to the FRA.

As the table indicates, a significant reduction applies for taking a Social Security benefit early. It’s important to note that the tables are unisex. Since women outlive men by more than two years (starting from age 65), based on life expectancy, women enjoy an even bigger reduction than men. Similarly, if a person delays the start of their benefit, he or she will receive an 8% annual adjustment for the rest of his or her life—basically an 8% guaranteed rate of return. Unless a person believes they are in ill health that would compromise an outlook for a long life, most would be much better off deferring their Social Security benefit to receive a higher lifetime payout. Of course, people must have adequate income to bridge the gap in their income need.

If someone is able to receive part-time income and defer Social Security benefits, they will be in a much better financial position. For example, employees of an independent insurance agency may find they can work on a part-time basis and defer when they receive their Social Security benefit. It’s good news that people are living longer, but it’s important to educate employees about how their retirement benefits work so they are able to make informed, long-term decisions.

Dave Evans is a certified financial planner and an IA contributor.