With mid-term elections right around the corner, why hasn’t the size of the federal debt been a big focus in the media or with politicians?

With mid-term elections right around the corner, why hasn’t the size of the federal debt been a big focus in the media or with politicians?

Over the past several years, a handful of scathing political battles have focused on the rising debt ceiling. In February of this year, after three years of skirmishes over the nation's debt and borrowing authority, the U.S. Senate approved a measure passed by the House of Representatives to suspend the debt ceiling until March 2015. The bill passed 55-43 on a strict party-line vote with only Democrats in support.

Although the issue appears to be on the backburner this year, the reality is the federal debt just reached $17,754,511,351,834. For those not accustomed to dealing in large numbers, that means that the U.S. is approaching $18 trillion in debt. And on a per-capita basis, it equates to more than $55,643 per person.

Over time, the federal government will have to rein in spending, increasing revenues and taxes and possibly curtailing federal “safety net” programs like Social Security or making them subject to “means testing.” As a result, Americans should focus on supplementing government programs. In fact, since 1984, the Social Security Trust Fund has accumulated more than $2.8 trillion in revenues that it has paid out in benefits. Social Security has essentially become a profit center to fund other spending since the $2.8 trillion in payroll taxes has not been set aside but rather “monetized” in the form of U.S. Treasury bonds. The government will either have to make the funds available for benefits—or trim benefits.

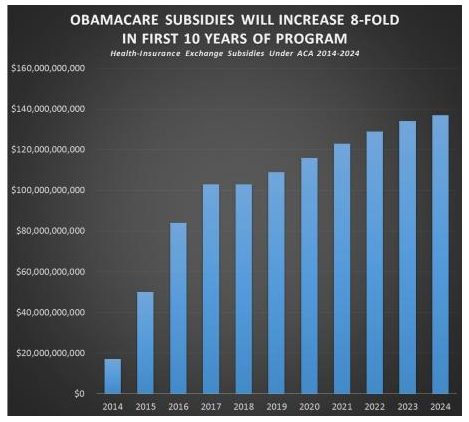

Another area of concern regarding the burgeoning cost of federal programs is the cost of the Affordable Care Act (ACA) subsidy the U.S. Treasury will pay on behalf of people who earn less than 400% of the federal poverty level and who buy a government-approved health care plan on a government-run health insurance exchange. This will increase approximately eight-fold in its first 10 years of operation, according to the latest budget estimate from the Congressional Budget Office (CBO). The CBO also estimates that Medicaid spending will double in the first 10 years of full implementation of the ACA.

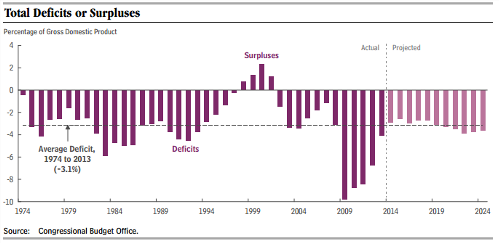

Political considerations aside, these yawning projections should serve as a warning for people to save as much as possible for retirement so that changes in the eligibility don’t derail planned retirement dates or someone’s standard of living in retirement. The two illustrations below indicate the level of deficits for the past 40 years and the CBO’s projections for the next 10 years, as well as the CBO’s estimates of subsidies under the ACA.

How big a role will the deficit and debt discussion play in the upcoming mid-term elections? Only time will tell—but the numbers are ominous.

Dave Evans is a certified financial planner and an IA contributor.