After a brief period of COVID-19-driven hesitation, the mergers & acquisitions market for agents and brokers has continued its seemingly ever-strengthening arc.

After a brief period of COVID-19-driven hesitation, the mergers & acquisitions market for agents and brokers has continued its seemingly ever-strengthening arc. Fueled by a combination of low interest rates, low tax rates, abundant capital and solid broker performance, momentum in the market continues to build. At this point, it is reasonable to ask whether anything can stop it.

After a brief period of COVID-19-driven hesitation, the mergers & acquisitions market for agents and brokers has continued its seemingly ever-strengthening arc. Fueled by a combination of low interest rates, low tax rates, abundant capital and solid broker performance, momentum in the market continues to build. At this point, it is reasonable to ask whether anything can stop it.

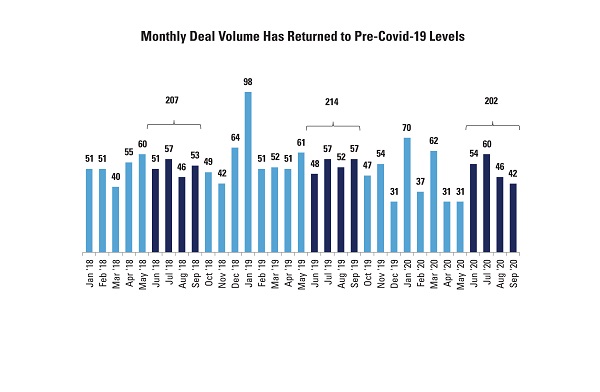

Deal activity has rebounded to pre-COVID-19 levels on a sustained basis. In the four months from June through September there were 202 announced transactions, which is on par with activity for the same period in 2019 and 2018, which recorded 214 deals and 207 deals, respectively. A normal level of activity in the fourth quarter would likely mean approximately 550 announced transactions in 2020. Despite the pandemic, that volume would be the fourth highest on record for M&A activity in our industry.

Meanwhile, valuations are exceeding pre-pandemic levels, especially for larger, high-quality agencies. This is happening for one reason: FOMO (fear of missing out). With a large number of well-capitalized buyers seeking a limited number of strategic acquisitions, buyers are left with a dilemma: Should we stretch our valuation to ensure we capitalize on an opportunity? Or do we risk missing out on a deal, slowing our growth trajectory and limiting our potential for accretive fold-in transactions? When strategic acquisitions present themselves, buyers are exhibiting a willingness to push valuations higher to avoid missing out.

Activity is back, valuations are up, and the market appears unstoppable. However, the next challenger is positioning itself to check the market's momentum: the state of Georgia.

The current M&A run has been buoyed by low corporate and capital gains tax rates. Preservation of these low tax rates, though, is most likely to continue in a divided government where Republicans control at least one chamber of Congress.

The equities markets signaled their enthusiasm for divided government in the first week of November. Public broker stocks were up an average of 5% in the days after the election when it looked like Democrats would control the presidency and the U.S. House of Representatives while Republicans would control the Senate. Now, ultimate control of the Senate looks like it will rest on two Senate seats to be decided in January runoff elections—both in Georgia.

Should Republicans hold the Senate via these Georgia runoffs, it would make two of President-elect Biden's stated tax policy goals less likely: higher capital gains taxes and higher corporate income taxes. Both changes, if enacted, could slow the M&A marketplace.

Higher federal capital gains taxes—Biden has suggested doubling these from approximately 20% to approximately 40% for high earners—may decrease the supply of agencies available for sale as the after-tax proceeds to agency owners would be materially reduced.

Additionally, higher corporate income taxes—Biden has suggested raising corporate tax rates from 21% to 28%—may reduce valuation multiples across the agency landscape as each dollar of profit would yield a smaller return to agency owners. Clearly, an M&A market where valuations are reduced and where sellers get to keep less of those values may be a bit less robust.

For now, the constantly peaking M&A market is at yet another all-time high. Voters in Georgia, though, may have the final say on whether that trajectory continues.

Brian Deitz is a partner at Reagan Consulting.