Ready for Lift-Off: 3 Coverage Considerations for Drones

As the Federal Aviation Authority considers the possible loosening of regulations for the drone industry agents and brokers need to be prepared for what’s to come.

As the Federal Aviation Authority considers the possible loosening of regulations for the drone industry agents and brokers need to be prepared for what’s to come.

As the commercial drone industry becomes less restrictive, insurers and agents are preparing for more opportunities in the future.

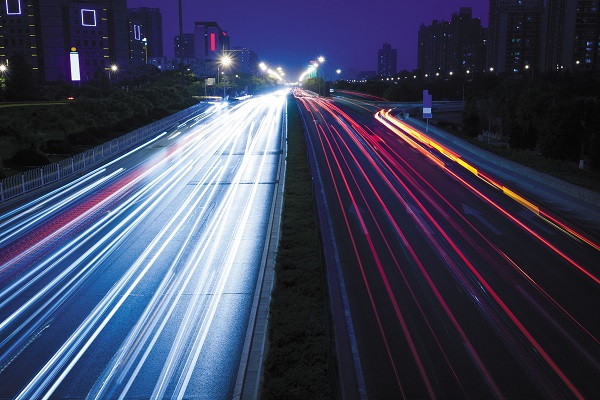

Why the coronavirus pandemic has accelerated the demand for usage-based auto insurance—potentially transforming the market forever.

When a commercial client includes a personally owned auto on the business auto policy, the agent must ascertain the legitimacy of the vehicle’s inclusion.

COVID-19 reached into the most basic aspects of daily life—handshakes, going to work, spending time with loved ones, and amid it all, Americans’ mental wellbeing.

Owners love their cars, showering them with tender loving care. They want coverage that will take care of them, too. Classic car insurance is the best way to keep your client’s classic or antique car safe and sound.

Workforce upheaval and the digital consumer revolution continue to disrupt the independent agent channel. However, these massive challenges can serve to benefit your agency and your business.

In today’s uncertain circumstances, it’s critical for agents to evolve business operations and adopt technology to continue to serve customers. Navigating change requires an explicit focus on three core principles.

Every day an independent agency’s employees and producers tap their computer keyboards, phones and tablets to log on to carrier websites. With each system login, they’re creating a risk to your technology security.

When Dutch McNeal and Sam Sports graduated from college in 2009, they were greeted by a recession and a decimated job market. When they discovered a local independent insurance agency with aging owners looking to sell, they took a “bucket shot,” as McNeal