The past four months have been a whirlwind of change for the entire nation. There are national health concerns about the spread of COVID-19 and how we contain it, as well as the concerns about the impact of COVID-19 on our economy. The insurance industry is not immune to these concerns.

I’m here to say that there is a basis to that concern—we all feel it—but the insurance industry is strong. Now is the time to show strength and capture the essence of what makes working with an independent agency great.

Through its personal lines comparative rater platform, TurboRater, Insurance Technologies Corporation (ITC) collects millions of carrier rates every month. That data, combined with our business intelligence and analytical products, provides valuable insight regarding the state of consumerism in the insurance industry.

Many concerned agencies and carriers have reached out to ITC to gain understanding of this insight and what is happening in the industry. We have included what we have found below.

Traditionally, the insurance industry receives an uptick in quoting volume in late February and early March because the IRS delays tax refunds until then that include the Earned Income Tax Credit or the Additional Child Tax Credit. This uptick usually peaks during the first week of March—this year is no different with the heaviest day being March 2.

Month-by-Month Data

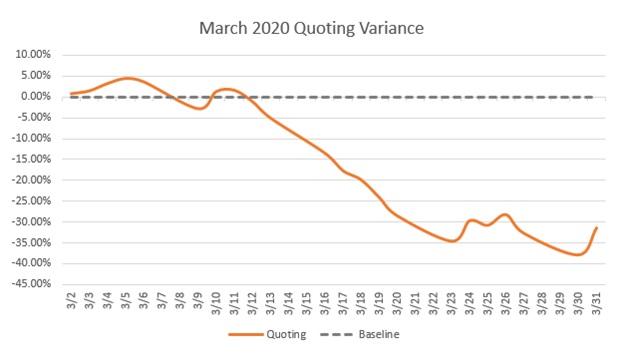

March: For the full month of March, ITC’s clients recognized a 13.5% decrease in expected quoting volumes, with the first two weeks representing 2.6% over the expected volume. The following two weeks saw quotes 28.3% below expected volumes. The final week of March settled in the mid-30% range below the projection.

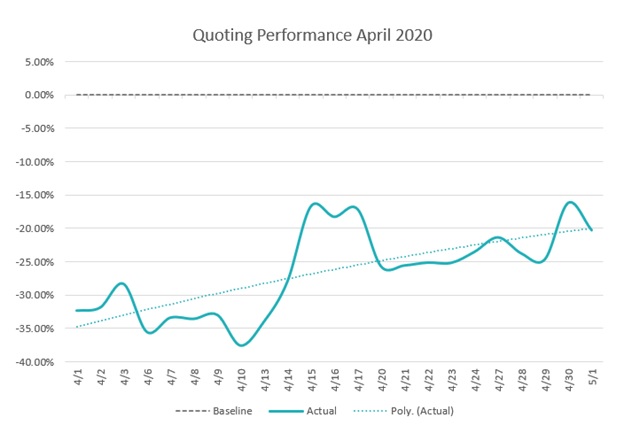

April: Throughout April, quoting volumes consistently improved, but at the beginning of April, things were looking dire: quoting volumes were 32.4% below expected numbers. The second week of April looked even worse with quoting numbers falling to 34.7% below expectations. The industry was reeling and reacting with carriers offering refunds to customers under the scrutiny of lower claim numbers.

The last two weeks of the month signaled a marked change with the introduction of stimulus checks. Consumers were building confidence and were starting to shop. Rating activities for the weeks of April 13 and April 20 ended at 22.9% and 25.1%, respectively.

This noticeable bump in the middle of the month signaled that consumers are still out there—it is the financial hardships consumers are feeling that is depressing insurance spending.

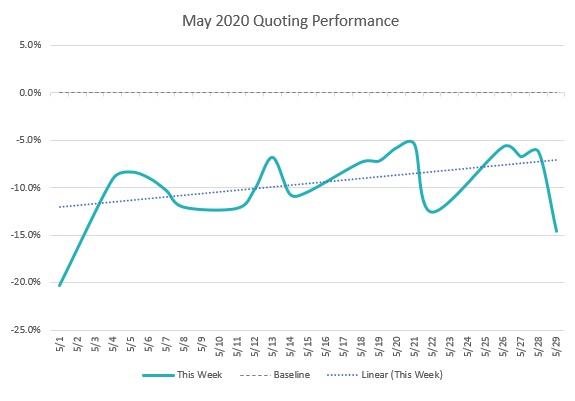

May: Throughout May, quoting volumes continuously improved week over week with the first week averaging 11.5% behind expectations, the second week 10% behind, the third week 7.6% behind and the final week settled at 7.4% below expectations.

While all states showed improvements, there were states that performed at higher than expected levels. Those states that reopened late April or early May showed drastic improvement compared to states that reopened toward the end of May.

June: As predicted, rating activity in June continued to improve as states reopened further. The month was the closest to projected rating volume since early March, ending at only 6% below expectations. But toward the end of the month the number of positive COVID-19 cases started to grow again in certain states and we saw this reflected in the decrease of rating activity in those states and continuing into July.

The above data is only the rating activities agents were doing in TurboRater and does not include any consumer-driven rating activities. Through our website platform Insurance Website Builder, our consumer rating platform TurboRater for Websites, and the TurboRater Rate Engine API, we’ve seen a different story.

For the month of March, online rating activities were 3% higher than expected versus the 13.5% decrease seen within agency quoting.

As shelter-in-place directives continued during April, consumers used online resources to transact their day-to-day business, including insurance. The numbers of consumers shopping for their insurance policy online outperformed the historical model of calling or stopping by the agency office.

Traffic to Insurance Website Builder clients was up 3%. Online quote requests and goal completions jumped considerably with these two online activities as high as 25.2% above expectations.

Agencies and InsurTechs that have invested in online properties with consumer-driven quoting have not been as significantly affected within their online activities as much as agencies that rely on foot, referral or phone traffic. Online insurance offerings are a significant opportunity for insurance agencies and carriers during the current situation.

I highly recommend that agents and carriers invest in their online properties. This may include insurance agency websites, automated agency marketing, and online comparative rating portals.

Nonstandard Markets

Nonstandard markets could be adversely affected above and beyond the current impact of the industry, according to J.D. Power. Their report shows a couple of factors could be driving this: nonstandard shoppers can be less aware of premium relief, or they are more likely to encounter financial hardship. Both of these could cause a higher incidence of shopping.

This argument doesn’t take into account an important component—nonstandard consumers are the regular and savvy price shoppers, and therefore there are already higher quoting and rating activities in nonstandard markets.

An argument can be made that nonstandard agencies are better prepared for a shift in buying habits. In the same J.D. Power report, consumers are looking to their agents and carriers for better rate management options. These include reducing premiums, forgiving missed payments, and suspending coverages at will. These actions are nothing new to agencies focused on volume sales.

I’ve had discussions with agencies across the nation, and those focused on nonstandard shoppers have seen a minimal downturn in business with active renewal, rewriting and education campaigns replacing any decrease in quoting.

Agencies that have focused on value selling are now facing the reality that their long-term clients have become price shoppers. These agencies will need to use assistive technologies to aid their client base at scale.

Methodology

ITC maintains a regular baseline of expected quoting volume for TurboRater. We also maintain an expectation of submission and traffic on the Insurance Website Builder, TurboRater for Websites and TurboRater Rate Engine API platforms.

We built the baseline on a model that reflects multi-year historical performance, usage of the platform, state demographics and market conditions using data from ITC’s business intelligence and analytical products.

The margin of error for the agency quoting and rating baseline averages less than 1.5% as calculated daily. The data analysis excludes rates returned without a premium.

The margin of error for the online properties and submission volumes averages less than 5%, as calculated weekly.

All models only attempt to predict Monday through Friday. Agency operations over a weekend have too much variability.

Laird Rixford is CEO of Insurance Technologies Corporation (ITC), a provider of websites, marketing, rating and management software and services to the insurance industry.