4 Common Coverage Gaps Agents Should Highlight for Cannabis Clients

Cannabis operators are facing increasing operational costs and liability risks and are looking to cut costs wherever they can.

Cannabis operators are facing increasing operational costs and liability risks and are looking to cut costs wherever they can.

The guidelines for the federally funded program include maintaining properties in compliance with local housing codes, passing periodic inspections by housing authorities and following strict eviction and lease termination procedures.

Challenges persist for the cannabis industry due to changes in the regulatory landscape, an increase in product recalls, increasing premiums and industry consolidation.

The coverage features a data-driven trigger, which removes the need to prove a covered loss or damage.

The uncertainty surrounding tariffs on key trade partners like Canada, Mexico and China have created immediate challenges for U.S. farmers.

With regulatory gaps and safety concerns surrounding hemp-derived THC beverages, manufacturers, distributors and retailers need to protect themselves with the right insurance coverage.

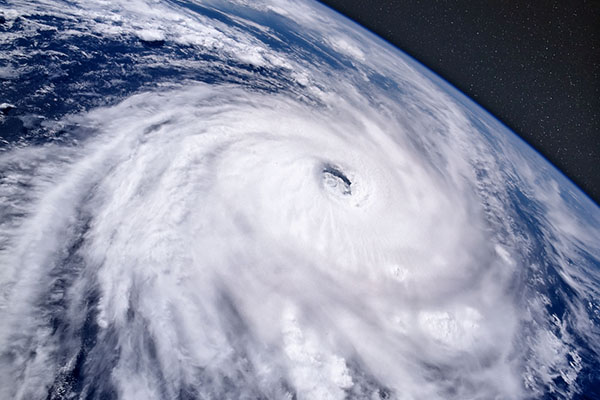

As severe weather becomes more frequent, it’s critical for agents to help clients understand what flood insurance does and doesn’t cover.

The excess policy provides follow-form coverage on professional liability coverage with limits up to $5 million and a minimum attachment point of $500,000.

The impacts from extreme weather events—made even clearer by Hurricanes Helene and Milton—have led to consumers reevaluating their flood risk.

Construction is the largest sector in workers compensation by premium and any changes to claims frequency will impact the entire workers comp market.