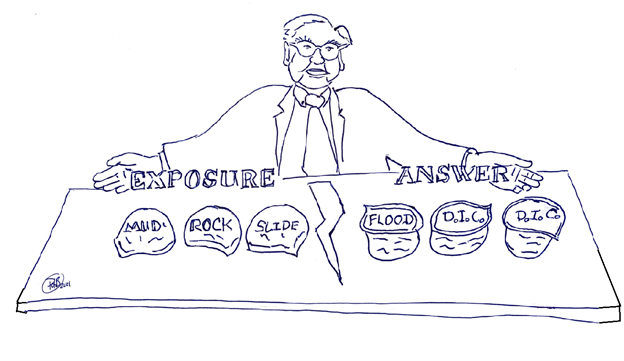

Homeowners Coverage Against Mud, Rocks and Landslides

By: Paul Buse

Recently, I attended a meeting of the Big “I” state association executives in Colorado. While I was there, an epic downpour of what can only be described as monsoonal rain caused flooding and created a muddy mess for some homeowners and renters. Between that and an article in the local newspaper on how homeowners were disappointed with having no insurance coverage, we had some interesting discussions over the provision of insurance coverage in mountainous regions.

Looking at the issues of rain, rocks and mud in the mountains can be compared to chocolate milk, chocolate cake and chocolate chunks.

The Avon, Colorado, monsoon event is chocolate milk. Homeowners saw their living space and possessions wetted and muddied—and when turning to their insurers, found they only had coverage if they had purchased a flood policy.

Here is language from a standard National Flood Insurance Program (NFIP) policy where the coverage is obviously provided:

Flood, as used in this flood insurance policy, means:

1. A general and temporary condition of partial or complete inundation of two or more acres of normally dry land area or of two or more properties (at least one of which is your property) from:

- Overflow of inland or tidal waters;

- Unusual and rapid accumulation or runoff of surface waters from any source;

- Mudflow.

For contrast, look at a standard homeowners, condo-owners or renters policy and see the corresponding exclusions for flood or mud damage to building coverage and coverage for contents. While coverage forms from various insurers do vary on some elements of coverage, virtually all standard homeowners, condo-owners and renter policies exclude damage as can be described as chocolate milk.

When it comes to chocolate cake, how many of you recall the massive landslide in Oso, Washington, about a decade ago? This landslide essentially rearranged the town, destroying nearly 50 homes. After that catastrophe, homeowners, businesses and tenants also found no coverage in their standard policies.

With the chocolate cake analogy, the issue is the earth movement exclusion in a homeowners policy like the HO 00 03 10 00, as referenced by the Insurance Information Institute:

SECTION I – EXCLUSIONS

2. Earth Movement

Earth Movement means:

- Earthquake, including land shock waves or tremors before, during or after a volcanic eruption;

- Landslide, mudslide or mudflow;

- Subsidence or sinkhole; or

- Any other earth movement including earth sinking, rising or shifting;

Caused by or resulting from human or animal forces or any action of nature unless direct loss by fire or explosion ensues and then we will pay only for the ensuing loss.

This Exclusion A.2. does not apply to loss by theft.

Now let’s turn to the chocolate chunks. In 2010, in Billings, Montana, a boulder sloughed off the area known as the Rims and knocked a house from its foundation. After other rockfalls occurred in 2018, the Billings Gazette reported that impacted owners of the house in 2010 sued their insurer, the city and the state but “lost on all counts.” Coverage was not provided because of the earth movement exclusion, as mentioned in the homeowners policy above.

As students of the industry, what is the takeaway here? For chocolate milk, offer flood—as explained here by the Insurance Information Institute. An option you may want to consider is the new private flood insurance market. They are extremely efficient on the mudflow question.

As for chocolate cake and chocolate chunks, seek a difference in conditions (DIC) policy. An earthquake policy might provide coverage, but the concern there is the policy, which is not standardized, might require general seismic activity. For member in the western states of Washington, Idaho, Montana, Nevada, Utah, Colorado or New Mexico, a homeowners catastrophe insurance trust coverage may be a good answer.

The key is to offer and to document. If you are in the mountains or anywhere boulders or land is uphill from the property, it’s a service to point these exclusions out, even if your clients don’t ask for that coverage specifically. And when you do—document, document, document.

Paul Buse is principal, founder and owner of Real Insurance Solutions Consulting.

This Student of the Industry article is part of a monthly column on IAMagazine.com. Keep an eye on Thursday’s weekly News & Views e-newsletter in October for the next off-beat take on current trends in the insurance industry.