8 Personal Auto Insurance Predictions: What’s In and What’s Out?

By: AnneMarie McPherson Spears

Will rising personal auto rates just keep going up forever? How long will consumers, agents and carriers alike have to cope with the supply-chain issues crimping the car repair industry? And weren’t we supposed to have self-driving cars by now?

A crystal ball sure would make insurance a lot easier. But until we have those, you’re stuck with these predictions from crystal ball non-owners on trends in personal auto insurance—what’s in, what’s out, and where it’s all going.

What’s In

1) Rising Rates. Auto insurance rates are anticipated to rise 8.4% across the U.S. in 2023, the largest rate increase in six years, according to ValuePenguin. Inflation is a key driver of increasing rates, as well as years of supply-chain pressure and the nation’s exit from the coronavirus era when carriers dropped rates.

“Insurers have very little motivation to overprice the product, so what you’re seeing right now is completely an outcome of the cost,” says Beth Riczko, president of property-casualty personal lines at Nationwide. “Right now, the industry’s losing money in auto because the pricing hasn’t caught up with the cost yet. Many companies are expecting that to shift, and we’ll get to a better balance as we go through 2023.”

Unfortunately, another factor impacting rates is driver behavior. “The number of fatalities that we see—hit pedestrians, vehicles striking motorcycles and bicycles—happen with too much frequency,” says Jim Hyatt, executive vice president and chief underwriting officer at Arbella Insurance Group.

And “the No. 1 driver of auto rates is bodily injury claims and medical expenses, which have led inflation for the last 30 years,” says Steve Shoultz, president of Priority Risk Management in Fishers, Indiana. “Obviously auto insurance has to go up.”

Increases in deadly motor accidents and an acceleration in medical inflation caused the average bodily injury claim severity to rise 24% from the first quarter of 2020 to the first quarter of 2022, according to a November 2022 report from the American Property Casualty Insurance Association (APCIA).

The big question is: How long will these rising rates last? “It all just depends on how much inflation goes up, and where claims go, but I think it’s going to take carriers at least two or three years to get caught up with how expenses have increased in the past two to three years,” Shoultz says.

One of the solutions is telematics adoption. While most are bullish about telematics and usage-based insurance gaining traction as consumers look for refuge from rising rates, the technology may not be able to save everyone from premium hikes. “If we look at the economy, accident frequency and severity, and rates, telematics is one of the only ways you’re going to be able to save money,” says Ellen Carney, principal analyst, application development and delivery, at Forrester Research Inc. “But we have seen discounts eroding. And we’ve started to see that if you’re a crappy driver, you’re going to be dinged for that.”

In 2022, 60% of consumers who were offered a telematics program opted to participate and most reported satisfaction, according to J.D. Power and TransUnion. However, over 40% of consumers still saw their rates increase.

“The value proposition of telematics is that consumers give up some sense of privacy or autonomy to provide insurers a demonstrably safe driving record in real-time,” said Michelle Jackson, senior director of personal lines market strategy at TransUnion. “If they’re not seeing that translate into lower rates, or if their rates actually increase, some may not continue with the program.”

2) Electric Vehicles. The wheels are in motion and the U.S. electric vehicle (EV) market is ready to take off, as anyone who watched the Super Bowl in February could have guessed—of the four car ads accompanying the game, three featured EVs. But while EVs are picking up traction, widespread adoption is most likely still a few years out.

In 2022, fully electric vehicle sales reached over 800,000 in the U.S. to hold almost 6% overall market share, nearly doubling from 2021, according to Motor Intelligence. Also, the Bipartisan Infrastructure Law passed in 2021 provided $7.5 billion to develop the nation’s EV-charging infrastructure in efforts to encourage consumers to join in on the Biden administration’s goal of EVs comprising 50% of all vehicles sold in the U.S. by 2030.

However, as supply-chain issues and inflation have dominated headlines, confidence in meeting that goal has dropped, with a 2022 KPMG survey finding that most auto executives think only 37% of new vehicle sales will be EVs by 2030, compared to 2021’s optimistic projection that EVs would be 65% of the market share in 2030.

In terms of personal auto insurance, EVs’ biggest impact will be in loss costs. “Since EVs represent such a small portion of the vehicle market for now, there are relatively few auto repair shops that specialize in EVs and few aftermarket parts suppliers are making inexpensive components to repair them after an accident. That drives up costs after a loss,” says Michael Giusti, analyst at InsuranceQuotes.com.

In terms of personal auto insurance, EVs’ biggest impact will be in loss costs. “Since EVs represent such a small portion of the vehicle market for now, there are relatively few auto repair shops that specialize in EVs and few aftermarket parts suppliers are making inexpensive components to repair them after an accident. That drives up costs after a loss,” says Michael Giusti, analyst at InsuranceQuotes.com.

“There is also the question of the battery,” Giusti says. “If a battery is damaged in a crash, there is a high likelihood that the vehicle is going to be a total loss because replacing the battery—for now—represents such a high portion of the vehicle’s value.”

In addition to the leaps and bounds EV-charging infrastructure must make to match the federal EV goal—the U.S. has 30 charging stations for every 100,000 people, compared to Norway, which has 313 charging stations for every 100,000 people and a car market that’s 75% EVs—pressure on beleaguered auto repair shops struggling with labor shortages will increase.

While 75% of independent auto repair shops indicate they’re now servicing hybrid vehicles, only 30% of those shops had invested in any hybrid or EV training for their techs, and only 27% had invested in tools or equipment for these vehicles, according to a 2021 IMR Inc. and AutomotiveResearch.com survey.

“I’m very concerned about the impact on mom-and-pop auto shops,” says Ryan Andrew, president of The Andrew Agency in Glen Allen, Virginia. “With the electric vehicle, you have to have a computer system to diagnose what’s wrong with the vehicle, which most small garages can’t afford, and then the customer is forced to take the car back to the dealership, which is typically a much higher cost than your standard garages. In the short term, I think the industry is going to be under a lot of pressure from a cost perspective as we attempt to transition over to a majority electric vehicle situation.”

However, in the long term, the U.S. market will do the same thing it did with the first horseless carriage: adapt. “As more EVs are adopted, market forces are going to take over,” Giusti says. “More repair shops will pop up. Aftermarket parts will begin to become available. In short, repair costs will come down.”

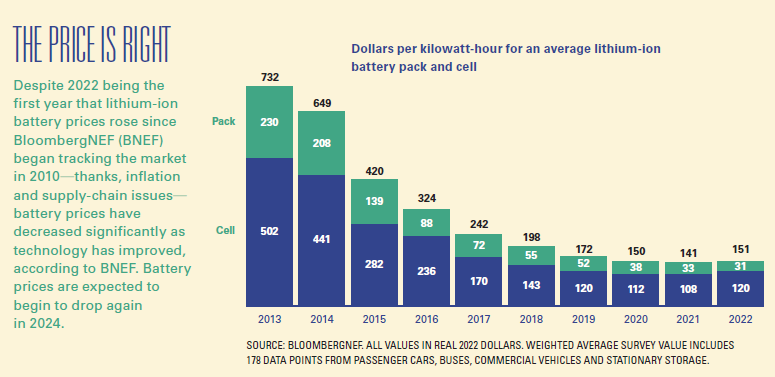

“Battery costs have already come down exponentially in the last few years, with lithium-ion battery costs dropping 85% over the past decade on a per-kilowatt-hour basis,” Giusti continues. “More EVs mean more competition and lower sticker prices and repair costs. In the end, the spread between insuring an EV and an internal combustion engine is going to be negligible.”

3) Safety improvements. By 2030, 9%, or $36 billion, will evaporate from the personal auto insurance premium pool due to improved car safety technology and a reduction of personal miles traveled, McKinsey projects.

Features such as rear cross-traffic collision warning, blind spot warning, adaptive cruise control, lane centering assistance and automatic emergency braking are the most popular technology-enabled safety features, according to a Consumer Reports survey, and some technologies, like backup cameras, are mandatory on all vehicles manufactured since mid-2018.

“Our data shows some advance driver assistance systems (ADAS) provide a significant reduction in loss costs,” says Mike Esposito, auto product development leader at Progressive. However, when drivers do get into an accident, the cost is often higher. “ADAS technology is often implemented with costly hardware, so reductions in loss costs must overcome those to result in a lower premium.”

As cars continue to come with more bells and whistles, the conversation may turn to whether too much of a good thing is harmful. “For a long time as an industry, we had a theory that all these ADAS are going to make us better, safer drivers,” Riczko says. “But there’s certainly evidence out there that what it does is give us permission to be pretty bad at driving.”

In fact, in a study comparing drivers who already owned ADAS-equipped vehicles compared to those who had no experience with it, AAA and the Virginia Tech Transportation Institute found that distracted driving behaviors like texting or adjusting the radio increased among the drivers that were experienced in operating with ADAS, while drivers with no prior experience paid more attention to the road.

“We’ll also have choices about personal freedom and how much permission people should have to make their own choices while driving,” Riczko adds. “Do you really want your car to have a max speed that’s equivalent to the posted speed limit? There are some interesting questions that will come up as we get further into this.”

4) Embedded insurance. Is embedded auto insurance—insurance that’s integrated into the car-buying process—the next threat to independent agents? It’s certainly emerging, with 72% of consumers preferring to have the opportunity to get auto insurance while purchasing a car at the dealership, according to a 2023 Polly survey.

“I can’t think of an auto manufacturer that has not asked us about the opportunities in embedded insurance,” Carney says.

One entrant into the manufacturer-offered insurance game is Tesla, which also cut EV prices in January 2023 in an apparent bid to boost sales. “There are a lot of catches to Tesla Insurance, though—for one, if someone has multiple vehicles in the household, only the Tesla is eligible for Tesla Insurance at this point,” Giusti says.

cut EV prices in January 2023 in an apparent bid to boost sales. “There are a lot of catches to Tesla Insurance, though—for one, if someone has multiple vehicles in the household, only the Tesla is eligible for Tesla Insurance at this point,” Giusti says.

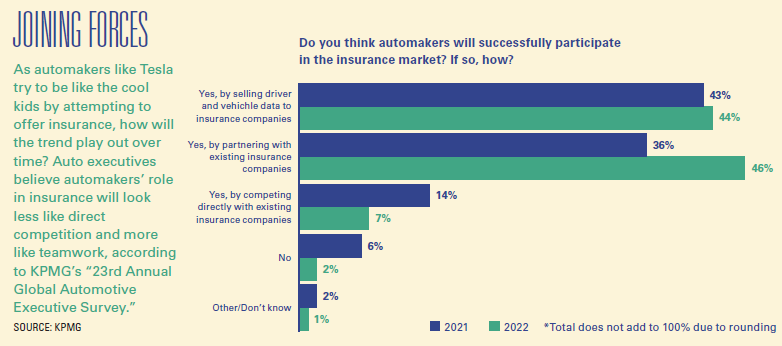

Interestingly, “Tesla is using anonymized telematics data from its onboard computers to build a risk profile of its vehicles,” Giusti says. “Most insurers are offering some option of relying on individual drivers’ habits to price policies, but Tesla is the first automaker that I know of that is working to show that the vehicle itself is worthy of a discount based on its safety features. That is a trend I could see more automakers moving toward in the near future.”

Ultimately, the issue with embedded insurance is that personal auto insurance “shouldn’t be treated as a transaction; it’s a financial contract—it’s in place to help you protect your financial assets,” Andrew says.

Another aspect, especially when it comes to the rating pressures we’re under currently, is that “even though a single-vehicle policy may cost less than what other companies are able to offer when you factor in the entire account from various discounts, it’s often in the best interest of the client to bundle the insurance and maximize the discounts,” Andrew continues.

“I’ve had a couple of clients who got a new vehicle and tell me, ‘Hey, I don’t need to add this to my policy because I already got insurance from the dealership,’ but these clients don’t know what coverage they’re getting,” says Donabeth Murray, personal insurance adviser at Goss Logan Insurance in Lebanon, New Hampshire. “I don’t understand how it’s favorable for the client because they have other vehicles, they also have homeowners and umbrella—we like to take care of the whole client and know exactly what’s going on there.”

“As we look at the rise of embedded solutions, the message to our agency partners is, ‘Hey, your biggest differentiator is the relationship you have with your customer,'” Riczko says. “Embedded solutions will find it hard to challenge good independent agents who’ve built that relationship with the customer—and they’ll find it easier to capture the part of the market where the customer doesn’t have a personal or strong relationship with an agent.”

To get ahead of the embedded insurance trend, Hyatt advises agents to talk about it. “In their social media posts, newsletters, websites and discussions with their customers, they should talk about the ins and outs of buying from Carvana or another organization with insurance embedded into the purchase of the vehicle, just so customers can understand what they should be buying,” Hyatt says. “It’s an opportunity to show the value the independent agent channel brings.”

What’s Out

1) Cheap auto repair prices. “We’re experiencing substantial increases for repairs, and it’s both a parts and a labor issue,” Riczko says. “And there’s been a lot of delays in repairs—for folks who have had accidents where the cars aren’t drivable—that means rental car times are longer.”

In addition to auto shops feeling the impact of the Great Resignation, “this has been driven by COVID-19-related supply-chain issues, which included semiconductors that are absolutely critical in new cars,” she explains. “It’s ameliorated a little bit, but I think the industry as a whole is expecting it to last longer than we did when we entered 2022.”

“With the chip shortage, more people are keeping their old cars on the road longer, needing more repairs,” says Nick Grant, senior vice president and co-lead of mobility solutions at Liberty Mutual and Safeco Insurance. “Add on the fact that auto repair shops are experiencing staffing shortages and increased labor costs, and the costs of repairs continue to be driven up.”

In the second quarter of 2022, auto claimants waited an average of 17.7 days for collision repairs, up from 13.2 days in the second quarter of 2021, according to a report from Enterprise Rent-a-Car, which is causing issues with rental car reimbursement coverage limits.

“Prior to COVID-19, throughout my entire career I could count on my hand the number of clients that had exhausted their rental car coverage,” Andrew says. “People have found out the hard way there is a limit to their rental car coverage.”

“Because we’re waiting on parts, it’s taking longer for claims to be settled. And the longer it takes to repair a vehicle, the more expensive the claims become,” Shoultz says. “People become very impatient and it’s more difficult to provide a good customer experience the longer it takes for the claim to be handled.”

Fortunately, relief may be on the horizon for next year—in the form of the Michelin man. “Michelin is coming out with a 3D printed tire next year,” Carney says. “With 3D printing, all those conversations we’ve had about supply-chain issues, globalization, all those things that have driven up claims costs, would be eliminated.”

As 3D printing usage picks up, it will have applications in precision engineering in complex and expensive projects, such as parts for aircrafts, cars and power stations, according to a 2022 Forrester report. “HP, Siemens and Volkswagen are collaborating on hardware and software innovations needed to print up to 100,000 structural car parts per year by 2025,” the report said.

2) Worries about ride-sharing (for the most part). Back in 2017, Independent Agent predicted that the sharing economy, including ride sharing, would be a real puzzler for the independent agency channel. Six years later, insurance solutions have mostly met the market need.

“Ride-sharing continues to be prevalent, and insurance has evolved to help drivers ensure they’re covered while working,” Esposito says, noting that ride-sharing companies are often mandated to provide coverage for drivers after they’ve accepted a trip and are transporting passengers or goods.

However, some of the finer details may not be covered without an endorsement. “A ride-sharing company’s policy may not provide coverage while a driver is logged in to the app and waiting to match with a request,” he points out. “A driver’s personal auto policy wouldn’t provide them with coverage during this time either. By adding a rideshare endorsement to their personal auto policy, drivers can fill this gap in coverage and have peace of mind knowing that they’re covered as soon as they begin working.”

In states that were late to permit ride-sharing insurance applications, like New York, “the personal auto carriers have not exactly rushed in to ensure these vehicle exclusions are standard,” says Tim Dodge, assistant vice president of research and information at Big I New York and a member of the Big “I” Technical Affairs Committee. “ISO recently published an endorsement for the personal auto policy that would cover the difference in deductibles—for instance, if someone’s driving for Uber and it has a $1,000 collision deductible but the driver’s policy only has $500, the driver could buy the endorsement and it would fill the gap. It’s still being rolled out though.”

While there are market solutions, agents should still be vigilant and ask customers about their participation in the ride-share economy. “They probably won’t think to tell you, and it could leave them with some coverage gaps for sure,” Dodge says. “At the very least, you need to know if anybody in the household is doing it and how it’s being covered.”

3) Self-serve InsurTechs. Reports of the demise of independent agents with the launch of direct-to-consumer InsurTech carriers turned out to have been greatly exaggerated.

“We’re seeing these InsurTech companies begin to understand it’s not as easy as they thought,” Hyatt says. “Those companies are really struggling to make money, and they’re struggling with the fact that every state in which they do business is different. That adds complexity and cost for those insurers that they hadn’t anticipated.”

Another factor that dampened direct InsurTech’s impact is “they had built their model based on distribution, creating more ways to get access to customers more quickly than through the traditional independent agency channel,” Hyatt explains. “And while they had the expertise around distribution, they didn’t have the expertise to back it up with service.”

“These companies are recognizing they can’t figure out how to go it alone, so they are turning to independent agents,” he says. In fact, Root announced in 2021 that it had plans to add independent insurance agents to its distribution team while Lemonade did the same.

“When you look at companies like Lemonade and Root, where they essentially didn’t start with a sizeable book of business with renewals, they’re facing a lot of pressure on the new business side,” Riczko says. “And it’s the dynamic of the customer who buys in that way—we know that a customer that’s multiline tends to be a stickier customer, where Lemonade and Root are effectively writing monoline business and attract people who will often shop and leave on a more regular basis. That’s expensive.”

While it’s certainly true that insurance consumers increasingly expect a digitalized experience, that doesn’t mean they don’t want the expertise of an insurance agent along with it. In a 2020 study of Australian Generation Zers, Forrester found that while 49% of respondents wanted to “be able to do everything I need to using an insurance mobile app,” 35% actually wanted to be able to use an app to contact an insurance agent.

And while Gen Z is the least likely (43%) to have worked with an insurance agent—compared to 84% of boomers who have used an agent—once younger consumers work with an agent, they are likely to do so again, according to a 2021 Agentero study. As many as 84% of millennials and 69% of Gen Zers are looking to work with an agent again—compared to 81% of boomers and 79% of Gen Xers.

Independent agents have proven their value time and time again. So, why is their share of the personal auto market only 32%, according to the 2022 Big “I” Market Share Report?

“Personal auto is really the only area where independent agents are competing in a four-person race,” points out Chris Boggs, Big “I” vice president of agent development, research and education. “Personal auto is where independent agents are competing against InsurTechs, captives and direct writers. On the positive side, the percentage of independent agent ownership of personal auto has been increasing slightly over the last five years.”

To win the race, agents “need a bit more tech support from their carriers to make quoting as quick and easy as it is online,” Boggs says. “When that occurs, we will take market away from the InsurTechs and even more away from the other distribution channels.”

“A lot of companies are offering apps, and in the future independent agents might want to utilize options to have their own applications, so those up-and-coming generations can still have a local agent and online or through an app,” Murray agrees.

4) Self-driving vehicles (for now). Tech entrepreneurs have been promising completely autonomous vehicles (AVs) for some time now, with Tesla’s Elon Musk telling journalists in 2022 that fully self-driving cars without the need for human supervision will be on the road in May 2023—which, unless drastic developments occur in the next month, isn’t looking likely.

Tesla is actually now in hot water with a U.S. Department of Justice criminal investigation for exaggerating its “self-driving” technology in advertisements and Musk’s tweets, after which a number of crashes, some fatal, involved their autopilot system. The Securities and Exchange Commission is also investigating the company’s statements about the autopilot system, and the U.S. National Highway Traffic Safety Administration has two active investigations into potential defects in the autopilot system. And in February, Tesla recalled all 363,000 U.S. vehicles with its so-called “Full Self Driving” driver assist software due to safety risks, according to CNN.

So, when will we have self-driving cars? “Based on our view of the market today, we foresee times for AV commercialization to vary based on use case. This could impact the way in which individuals interact with their own personal vehicle but will likely have small impacts on personal insurance in the short term,” Grant says. “We believe that the impacts in the medium to long term, however, will be much more profound as fully autonomous private passenger vehicles will likely become available in the next 15 to 20 years.”

When autonomous vehicles are on the market, “we’ll have a whole lot of interesting implications,” Carney says. “Probably less car ownership, since you could just hop into a wandering vehicle and listen to marketing messages in exchange for a free ride, and probably more product liability kinds of coverage or more parametric coverage.”

And of course, the question of liability will become increasingly complicated. “Who is going to be liable for an accident?” Dodge asks. “Is it the manufacturer? Whoever built the software? Does the owner have some responsibility even if they’re not touching the wheel? That’s all the stuff the courts will have to work out over a period of time.”

While no one has the crystal ball, one thing about the future is certain: The personal auto insurance market will look very different 20 years from now. And further down the road, there may not even be need for roads.

“United Airlines, Delta and American Airlines have each bought around 200 flying cars,” Carney says. “It’s probably an experiment, but at what point in time is that going to hit the radar of the independent agent?”

AnneMarie McPherson Spears is IA news editor.

Out of Style: Bad DataAs telematics and computerized EVs continue to hit the road running, the personal auto industry will have more data than ever before on drivers. But clunky usage is causing frustration among both agents and consumers. “The industry as a whole is probably one of the biggest purchasers of data out there,” Andrew says. “Telematics, while it can provide some useful information and most likely replace some of the historical factors that we use, still needs to be taken into context with a more balanced approach.” Andrew cites two examples of his customers’ frustration over impersonal telematics experiences. “A client got a less-than-favorable report due to the time of night she was driving. Well, she was a night nurse,” he says. “She wasn’t getting the discounts she was entitled to simply because she was driving after 11 p.m. Another situation is hard braking, and depending on the traffic flow, you could be the best driver in the world, but there are times when you have to hard brake.” As carriers continue to gather data, there’s hopes that, with course corrections, rating will become more accurate on an individual basis. “I think as more people use telematics, the rates are going to become more personalized,” Shoultz says. “I actually think we’ll start to see rates increase, because carriers will have the data to show that rates should increase.” “Of course, maybe the data will show that rates should lower for some people,” he continues. “I’ve always felt the difference in rates between teenage boys and teenage girls is an outdated model.” Incomplete data has impacted agency-carrier relationships as well. With the Great Resignation resulting in understaffed underwriting teams, some have turned to using generative artificial intelligence (AI) to process claims. “In some cases, it’s just you and the computer,” Andrew says. “It’s been very difficult to manage when something is not correct, and you’re trying to get something pulled out of the queue so it can be corrected. Often, agents are just saying, ‘I’m going to cancel this policy and just get a new one.'” —AMS |