New ISO Business Auto Changes

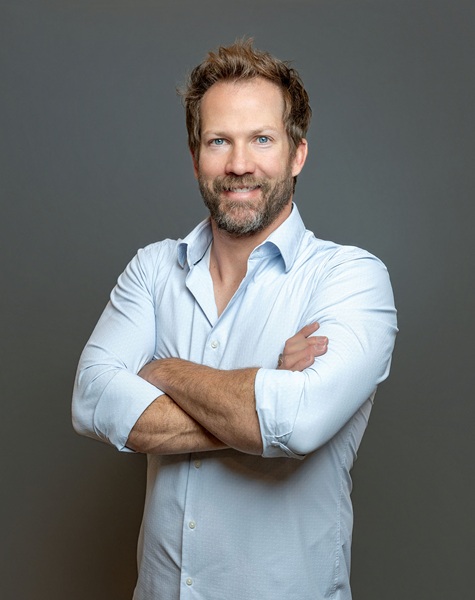

By: Bill Wilson

For more information, click here.

Summertime Blues

Summer brings many things: vacations and travel, sunburn and poison ivy, weddings, moving, houseguests, cookouts, rental cars, jet skis and many insurance questions.

Do homeowners policies cover owned or rented watercraft, camping trailers and other equipment away from the premises? How about hotel and condo vacation rental exposures? Does the personal auto policy cover rentals of cars on vacation or moving vans to get from an apartment to a new home? How about motor home or ATV rentals?

Do insureds renting sailboats, jet skis or other watercraft have liability coverage or coverage for damage to the craft? What about liability coverage for premises rented for weddings and the property exposures presented by wedding gifts?

For answers and more questions, click here.

The Theft “Inventory Shortage” Exclusion

The Special Causes of Loss form excludes losses “where the only evidence of the loss or damage is a shortage disclosed on taking inventory.” In other words, if you conduct an inventory and find something missing, that doesn’t necessarily mean it was stolen. But what does it mean?

This exclusion has been around since at least 1957 and is found in both property and crime forms. The purpose of the exclusion is to preclude coverage for theft losses where the only evidence is via an inventory.

In high school I worked at a grocery store and we took inventory every Saturday night. We compared sales receipts and physical shelf inventory to delivered goods. In the vast majority of cases where there was a discrepancy, it was a shortage.

However, just because goods are missing doesn’t necessarily mean they were stolen. Sometimes there was a mathematical error in counting incoming merchandise and/or shelf stock. In many cases, it involved damaged merchandise such as the jar of pickles that was dropped and broken but never noted on the inventory. So, if the only evidence of missing property is inventory calculation, it is insufficient to trigger theft coverage under the policy.

For a detailed analysis, click here.

Bill Wilson (bill.wilson@iiaba.net) is director of the Big “I” Virtual University, an online learning center for agents and brokers.