Why Professional Services Need to Take E&O Seriously

Professional services firms are walking a tightrope between opportunity and ruin, which means errors & omissions coverage is essential.

Professional services firms are walking a tightrope between opportunity and ruin, which means errors & omissions coverage is essential.

When life gives you lemons, independent agents and brokers errors & omissions coverage is a key contributor to the longevity of an agency—but only if the policy is covering the right exposures.

A look back at the causes of errors & omissions insurance claims in 2020 and how to make 2021 a better year.

Before buying or selling an agency, thinking about errors & omissions issues beforehand will help avoid difficulties down the road.

Insurance agents need to be careful and take appropriate steps to avoid errors & omissions claims that allege they failed to offer uninsured/underinsured motorist and umbrella coverage.

Before placing errors & omissions coverage with any carrier you are appointed to represent, consider these five factors.

How inadequate training, merger & acquisition slip-ups and faulty technology processes cost agencies.

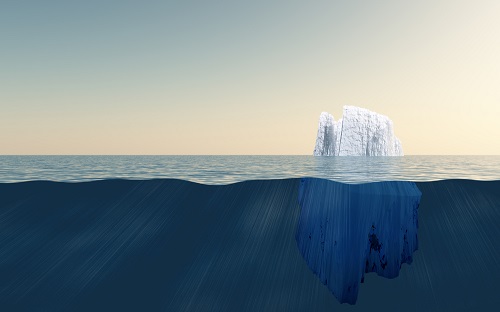

A prospect bought a warehouse for $1 million. The replacement cost is $25 million but the owner only wants to protect their investment and has said they wouldn’t replace the building in the event of a total loss.

Wouldn’t it be nice to know? This month’s Student of the Industry article takes a look at the data.

With a $5-million aggregate limit in place, most agencies believe they are unlikely to be overcome by a series of small, unrelated claims in a single policy period. There is some truth to that but some peril, as well.