Are PDF Insurance Applications Dead?

By: Adam Bratt

If you think you’re embracing technology by using PDF insurance forms, think again—your customers don’t agree.

The portable document format (PDF) has been around since the early 1990s, when it was invented to ease the process of moving documents from one system to another—such as from Windows to Mac—without destroying the document’s format.

As Adobe puts it, the creative minds behind the PDF were trying to find a way around “the inability to exchange information between machines, between systems, between users in a way that ensured that the file would look the same everywhere it went.”

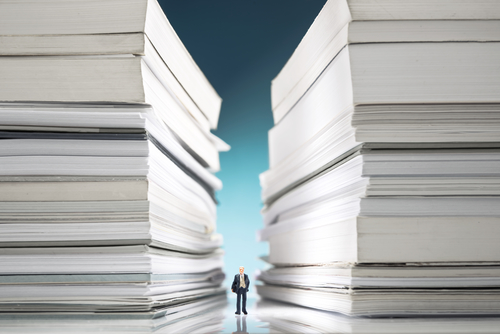

The PDF was indeed a success for its intended purpose. But while it’s a step up from filling out applications with a pen, it doesn’t provide the level of interactivity or automation today’s customers increasingly demand.

Today, PDFs hardly qualify as digital documents, and they aren’t really suitable for online use. The qualities that make PDFs superb for document publishing can become drawbacks when this format is used for collecting data. And because the PDF was invented before the rise of the internet, it just wasn’t designed for today’s ultra-connected world.

Here are five reasons your customers don’t like PDF insurance applications:

1) PDFs are difficult to read on a screen. Because the PDF was originally intended as publishing software, its documents are designed for the printed page rather than for a monitor. That can make PDFs a pain to read on a computer. They also lack the responsiveness of a webpage.

2) Customers can’t readily make edits—and neither can you. A computer treats a scanned PDF as an image rather than a living document. That means it can’t be edited the way a Word document can. PDFs converted from Word or similar programs are easier to edit, but still aren’t terribly flexible. A properly designed PDF allows customers to fill out form fields on the computer, but that’s about it.

3) PDFs often confuse customers. Insurance applications are rife with confusing questions, and simply sending a PDF to a customer and expecting them to figure it out can cause huge frustration. Unlike web applications, PDF documents don’t allow you to include explanations of what a particular question means, or whether it applies to that specific customer.

4) Customers might not even get the PDF. Because PDF spam has become popular in the last few years, emailed PDFs often end up being captured by spam filters. This can cause delays and hassles in an already complex application and renewal environment.

5) Customers must repeat information across documents. If you have multiple PDF insurance applications with the same questions, the customer is forced to fill them all out individually. There’s no way to transfer answers from one document automatically to another.

We no longer need a rigid format to retain document structure because we can use HTML-based webpages to not only accomplish that purpose, but also give users tremendous flexibility and interactivity. Webpages are also far more accessible than PDFs, particularly on mobile devices.

Unlike a PDF, a modern insurance application platform is designed with automation, interaction and seamless data sharing in mind, improving efficiency and convenience while making the process truly digital—and a lot less frustrating.

Insurance customers are growing accustomed to the smart, interactive solutions that they’re familiar with in other aspects of their lives, for both their business and personal needs. PDFs and paper insurance applications are dead. It’s time provide them with a better system experience.

Adam Bratt is CTO of Indio Technologies, a software providing commercial insurance agencies a modern, digital application process for their insureds.