DOL Issues New Worker Classification Rule

By: Eric Lipton

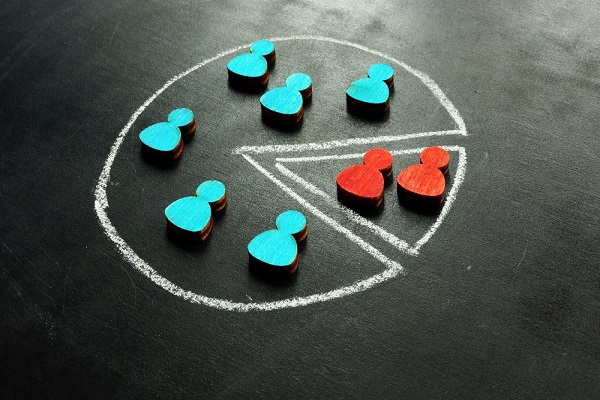

The U.S. Department of Labor (DOL) has issued a new final rule intended to clarify the standard for determining whether a worker is an employee or an independent contractor under the Fair Labor Standards Act (FLSA), which governs federal minimum wage and overtime pay requirements for employees. The proposed rule went into effect on March 11.

The new 2024 independent contractor rule replaces the prior rule which focused on two “core” factors of the economic realities test: the worker’s nature and degree of control over the work, and the worker’s opportunity for profit and loss. The 2024 rule rejects that approach and restores a totality-of-the-circumstances analysis that weighs six non-exhaustive factors.

The DOL indicated that the new rule is intended to be more robust and should result in more workers being classified as employees, even if an employer and worker intended for the relationship to be that of an independent contractor.

The new rule is subject to legal challenges in federal courts and the DOL may again change the test in the future. Employers should continue to consider applicable federal, state or local laws and take steps to try to ensure their workers are properly classified. Employers may also need to apply different sets of worker classification tests, including those established by applicable state laws. Examples include the common law control test, the Internal Revenue Service’s expanded control test, and the ABC test used in many states.

For more information on this issue, the Big “I” Office of General Counsel updated its memo, “Worker Classification: Employee vs. Independent Contractor,” which provides an overview of the most commonly applied tests.

If you have any further questions about this or related topics, contact Nathan Riedel, Scott Kneeland or Eric Lipton.

Eric Lipton is Big “I” senior counsel.