5 Myths About Agency Values and Private Equity Buyers

By: Jeff Smith

The private equity (PE) infusion into the independent agency system is a fairly recent phenomenon that has created a fundamental realignment of the agency business model. It has also created an unprecedented number of myths and misperceptions about agency values and selling options.

With estimates of $25 to $35 billion invested in the independent agency system in the past 10 years, PE investors have discovered the sound fundamentals of independent agencies and have created more options than ever for agents looking to sell their agency, retire or change their day-to-day business activities.

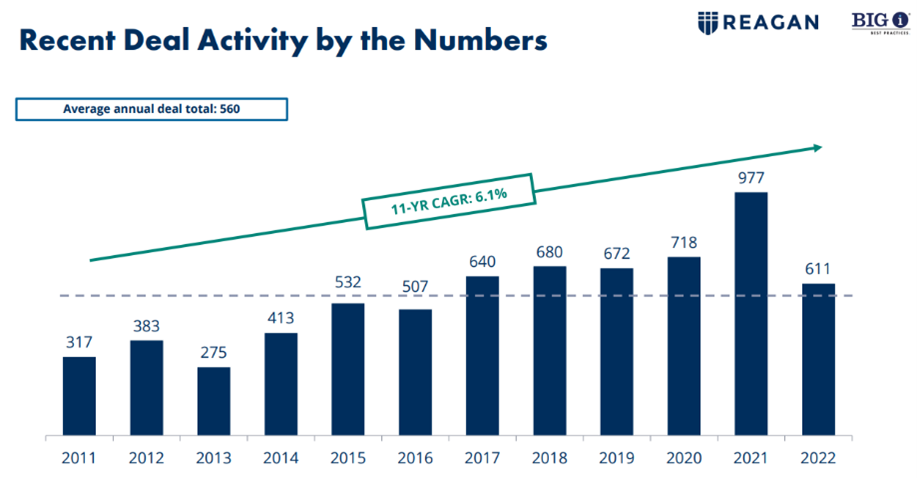

While there was some pullback in mergers & acquisitions in 2022, the independent agency system is continuing to experience record levels of M&A activity, and we expect this trend to continue in 2023 and beyond.

PE buyers are responsible for 77% of the publicly reported acquisitions in the independent agency system, according to SNL. As shown in the “Recent Deal Activity by the Numbers” graph, the role PE buyers have played in the M&A space has become increasingly prevalent over the past decade.

Increased M&A activity and PE buyers have helped drive agency values higher and created a significantly broader marketplace for buying and selling independent insurance agencies. While the rising tide has lifted all boats, how high each agency has been lifted varies greatly based on the profile and performance.

With some insight, privately held retail agencies can increase their agency’s value. However, there are some prevalent misperceptions about PE buyers.

Let’s start with a common conversation between agency owners:

Agency Owner 1: “My agent buddy told me they just sold their agency to a PE broker and got three times the agency revenue, guaranteed cash paid in a lump sum. He is now planning to retire in six months and move to the beach.”

Agency Owner 2: “That sounds amazing. I am going to approach them to buy my agency too. What did he do to sell the agency?”

Agency Owner 1: “Nothing! He just responded to a call from the PE broker. They made a cash offer, conducted the due diligence and 30 days later purchased the agency. In fact, he got multiple calls from various brokers interested in buying his agency.”

Agency Owner 2: “I’ve got to get in on this. If that agency sold for three times the revenue, I think I can sell for four times. My agency is worth way more than theirs.”

Within this conversation, there are various myths and misperceptions. Here’s the truth about five of them:

Myth 1) Multiple PE Buyers Will Make Generous Offers to Buy My Agency

Myth 1) Multiple PE Buyers Will Make Generous Offers to Buy My Agency

Fact: Agency owners have more options to sell their agencies than ever before. This includes all buyer options: PE buyers, publicly traded brokers, banks and privately held retail agencies.

Myth buster: You may get multiple, lucrative offers for your agency, especially if it generates over $1 million in revenue, has had three consecutive years of double-digit organic growth, operates at a 35% EBITDA profitability margin, is 70% commercial lines, is located close to a growing major metropolitan area and has validated young producers. These agencies exist, but they are not the norm.

The average agency has seven employees, generates $600,000 in revenue, has flat to single-digit growth, has a 15%-25% EBITDA profitability margin and is split 50/50 between personal and commercial lines. Therefore, the average agency is not likely to draw much interest from PE buyers.

Depending on the PE buyer platform, the average agency may be considered as a tuck-in acquisition opportunity, but the offer is going to vary greatly based on the agency. If you want to maximize your value and attractiveness to PE buyers, grow by double digits, manage your profitability margin to 35% and focus on commercial lines. However, doing all of those simultaneously is very difficult.

Myth 2) PE Buyers Will Pay a Lump Sum 3 Times Annual Revenue for My Agency

Fact: If you require it, every buyer in the marketplace will pay you something up front for your agency. The multiple that any buyer will pay varies greatly, depending on the past and future performance of the agency.

Myth buster: Unless you are planning to severely discount the price of the agency, it is unlikely any buyer will offer you the highest value in a lump sum cash payment. Almost all PE buyers structure their offers like this: a meaningful lump sum guaranteed payment up front, a three-year earn-out, equity in the PE broker, and a salary and commission for your continued services and benefits as an employee.

The likelihood that you will get three times annual revenue guaranteed up front is slim. If you are a top-tier Big “I” Best Practices agency this is possible, but is highly unlikely for most agencies. If PE buyers are interested in your agency, they will structure a deal with you. It will be packaged to look really enticing—like five times annual revenue enticing.

A PE buyer once compared the PE term sheet to describing your golf handicap in the clubhouse. Talking to your buddies, you are a 5 or 6 handicap. When the club is in your hand, you are a 15 or 16.

Myth 3) I Can Coast After I Sell My Agency to a PE Buyer

Fact: You have to hustle like never before for at least three years to achieve your earn-out to maximize the sale of your agency.

Myth buster: Typically, 25% of your sale transaction is packaged as an earn-out over three years and many of the earn-outs do not pay a penny unless you achieve certain growth metrics, such as 5% or 10% year-over-year. In addition, many have three-year earn-outs that compound year-over-year, which essentially requires 30% growth over three years to hit that performance bonus.

If you have not grown by these percentages in the past few years, you should question whether those expectations are attainable. An offer may look good on paper, but if you have a zero percent chance of reaching the growth metrics to trigger the earn-out, your deal is worth a lot less.

Myth 4) PE Buyers Will Buy My Agency in 30 days and Allow Me to Retire Within 6 Months

Fact: A PE buyer is highly unlikely to be involved in this scenario. They expect the owners to stay on board and help grow the agency. Many require the owner to take an equity position in the company as part of the financial package to ensure they stay committed to growth.

Myth buster: PE buyers invest in growing assets. Gone are the days when PE buyers purchased declining agency assets, gutted the expenses, sent the accounts to service centers and hoped to hold onto as much revenue as possible.

PE buyers perform sophisticated due diligence processes, and a deal is unlikely to complete in 30 days. Most take 90 to 180 days to complete the transaction—from the first conversation, a non-disclosure agreement, offer, letter of intent and purchase agreement. During the due diligence process, you must gather all financial reports and carrier production and performance-related reports for the buyer to analyze.

For the most part, private equity buyers are sophisticated operations built for future growth. If they are not already, these operations will be your fiercest competition for large and middle-market commercial lines and high net-worth personal lines accounts.

They actively recruit producers, they have training programs, focus on specialization and manage accountability around organic growth. PE buyers operating in this environment are unlikely to pay top dollar for your agency and allow you to retire.

Myth 5) Nothing Will Change After I Sell My Agency

Fact: Everything will change after you sell your agency.

Myth buster: You will no longer be the owner of your agency, you will be accountable to someone else and you will give up your autonomy. It is possible the name of the agency will be retained. You may still manage the local operation and maintain the outward appearance of ownership or leadership.

However, the culture of the agency will change. Technology systems, carrier relationships, staff accountability and expectations will change. Marketing budgets, support of your local community and brand will change. Growth goals, activity tracking and expense management will change.

These factors are arguably more important than any of the financial factors. Cultural fit and finding the right values are of critical importance in this process. You want to be happy after the sale and feel confident that your clients, community, employees, carrier partners and legacy will all be taken care of after the deal closes.

Jeff Smith is CEO of the Ohio Insurance Agents Association.