How Data Drives Accurate Rates

By: Heather Day

With apologies to the world-famous groundhog Punxsutawney Phil and his fame as the “seer of seers, prognosticator of prognosticators,” I doubt any person—or animal—can predict the future quite as well as data.

Thankfully, unlike Phil, insurers don’t have to look for shadows to help predict the future. We can use data to inform predictive models that help us calculate the likelihood of future claims. That, in turn, helps us offer fair rates, which we define as rates that accurately reflect expectations of future costs.

Data helps independent agents win in the marketplace—with it, insurers can offer you a wider range of rate options for a wider range of prospective clients; it expands your market and opportunities to grow your business.

Conversely, without this data, options dwindle and agents lose their competitive edge as trusted counselors who can help consumers navigate the sometimes tricky world of insurance coverage. Without access to this kind of predictive data, agents and consumers would face “an unsettled marketplace resulting in reduced availability of insurance carriers and increased premiums,” notes Frank A. Jones, partner at Mints Insurance in Millville, New Jersey.

Predictive Driving and Other Data Helps All Consumers

As you can imagine, the industry reveres data. But, of course, it’s only useful if we’re studying the right data.

That’s why we only focus on predictive variables that can be analyzed in a highly disciplined, process-driven and scientific manner. While the mechanism for pricing can seem complicated, the goal is very simple: Price each policy according to its expected costs, no matter who’s insured by the policy.

I cannot stress that last point strongly enough as we completely agree with regulators that race, income, religion and ethnicity have no place in ratemaking.

So, what kind of data do we at Progressive review to predict future costs? Pat Callahan, president of personal lines explains our philosophy.

“Based on all the data we’ve been approved to collect, analyze and test throughout our 84-year history, the best—and most fair—way to price policies is to use the more than 70+ driving and other risk variables in our product model to predict the likelihood of an accident and the cost of that accident,” he says. “These variables yield insights that lead to more accurate pricing and assures that no single rating variable has a disproportionate impact on an individual’s premium.”

As Callahan notes, Progressive uses a wide variety of objective data and hundreds of millions of data points that are proven to accurately predict a driver’s likelihood of having an accident and the cost of a resulting claim. These data variables include driving factors such as driving records, traffic violations and claims history, and other risk factors such as insurance scores that are highly predictive of future insurance claims. With access to this data, we can offer independent agents accurate rates, which means more options for more customers.

Most of us can understand analyzing driving data, but why analyze other risk data? And why credit report information in particular?

While financial credit scores are built on credit report information and used by lenders to predict how likely it is that they’ll be repaid on time if they give a person a loan, insurance scores—which also use data from credit reports but have nothing to do with lending credit scores—are designed to predict car accidents and insurance claims.

Insurance departments regulate what elements of the credit report can be used by insurers and virtually all states permit insurers to create insurance scores from credit reports that help us calculate more accurate rates for all. We’ve validated this time and time again through our in-house analysis.

Still not convinced of the value of other risk variables? Let’s compare it to what we see in our telematics data, or usage-based insurance program that personalizes rates based on how drivers actually drive.

Progressive is a pioneer in this space, with nearly 30 years of experience monitoring consumer driving behaviors and applying those insights to how we rate customers. Our Snapshot® program has collected 33 billion miles of data over the course of 4.5 billion consumer trips and demonstrates a clear link between risk scores based on credit information and driving behaviors.

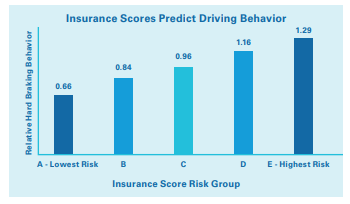

For example, in the chart below, you can see how lower risk scores correlate to better driving behaviors and vice versa.

In fact, when we analyze our telematics data against other predictive risk variables like education, occupation, gender and marital status, we see similar relationships. Telematics data proves these variables are correlated to driving behaviors.

These variables factor into our pricing to help ensure we can continue to provide independent agents with accurate rates and more options for their customers. We’ve shared our studies on predictive risk variables with public policymakers, industry associations and other parties. The evidence we see is undeniable, and additional third-party and industry association studies continue to show that these other risk variables are powerful predictors of future claims.

Cloudy Data, Cloudy Forecasts

Cloudy Data, Cloudy Forecasts

Progressive’s corporate headquarters proudly calls Northeast Ohio home, and if you know anything about the Midwest, it’s that complaining about the accuracy of weather forecasts is our regional pastime.

But truth be told, it’s incredible how accurate these forecasts turn out to be. Like insurers, meteorologists’ ability to leverage proven scientific tools, models and data undoubtedly account for their predictive accuracy.

Can you imagine taking away access to a key tool like radar? Forecasts would suffer.

The same is true when it comes to insurance pricing. From time to time, regulators push to ban the use of certain tools or other risk factors, such as insurance scores, because some believe they unfairly penalize minority and low-income groups.

Our research, as well as research from many third parties over the last 20 years, shows that other risk variables like insurance scores help safe drivers across all minority and income groups by allowing the insurance industry to accurately measure risk.

Progressive’s data reveals two key points that should interest all consumers and independent agents.

“First, more than half of auto insurance consumers would miss out on the benefit of a reduced insurance premium if an insurance score was banned,” says Theo Bell, senior product manager at Progressive and an in-house expert on risk-based pricing variables. “And second, insurance scores are widely distributed across each and every racial group and income segment, so removing this tool would take benefits from the very people many proponents of a ban are trying to help.”

While well-intentioned, efforts to ban other risk factors like insurance scores are likely to do more harm than good.

Removing these predictive factors from pricing would disrupt the insurance market and cause millions of drivers to pay higher rates, including many drivers these efforts benefit. Briefly summed up, effects include:

- Safer drivers would pay higher rates to subsidize less-safe drivers.

- Responsible low-income drivers of every ethnicity would pay much higher rates.

- Insurers and local independent agents would have a less competitive product to offer their communities.

- Higher-risk drivers could find it much harder to stay insured, and independent agents would find it harder to place these customers and build their businesses.

Seniors would also feel the brunt of any rate increases that would likely result from any type of insurance score ban. Today, seniors make up a large portion of the top two most favorable credit tiers. Progressive’s analysis shows that if we were to remove insurance scores from our rating calculation, over half would face higher rates that cost them on average a few hundred dollars more each year.

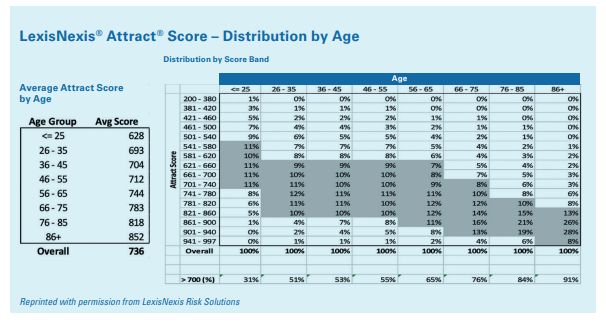

Additionally, recently released research from leading data and analytics vendor LexisNexis® Risk Solutions shows that seniors have better Attract® scores, which is their proprietary credit-based insurance risk scoring model.

Additionally, recently released research from leading data and analytics vendor LexisNexis® Risk Solutions shows that seniors have better Attract® scores, which is their proprietary credit-based insurance risk scoring model.

As you can see, the average score for seniors ages 56-65 comes in at 744—falling firmly in a favorable risk category. And that average score only goes up per older age group categories. This reinforces our research that shows most seniors’ rates would rise if we were prohibited from considering credit-based insurance scores.

To help us better understand the real-world impact of any ban on insurance scores on minority communities, we consulted with Tami Ellingson, an independent agent in Lakewood, Washington.

While Progressive doesn’t collect race information for our customers, Ellingson shared policies for three random minority clients insured by Progressive and asked how their rates would change without factoring in insurance scores. Our findings showed:

- A 72-year-old African American male working at an auto parts company would see an increase of over $300.

- A two-income Hispanic family employed by a hotel would see an increase of over $600.

- A single, college-educated African American female would see an increase of over $300.

Bans on highly predictive risk variables like these can harm a broad cross-section of consumers, regardless of age, ethnicity, race or income level. Like a meteorologist banned from using specific, proven weather-predicting tools, bans on tools like insurance scores would limit insurers’ ability to predict future outcomes to settle accurate rates.

Data for a Clearer Future … For All

In the end, the insurance industry is looking at science—data science, to be exact—not shadows, to support a vibrant, growing marketplace for independent agents and their customers.

For our industry and the health of the independent agency channel, the ability to responsibly underwrite and price risks based on highly predictive data helps both consumers and independent agents benefit with lower rates, more choices, and greater market and price stability.

It’s understandable that other risk variables can seem counterintuitive to the uninitiated, but as shown here, they play an important role in helping insurers offer accurately priced rates so independent agents can serve more customers.

We encourage all independent agents to stay informed and engaged with public policy discussions on this issue—and if bans or other limitations are up for debate in your state legislatures, let your state lawmakers know that you oppose efforts to remove this powerful tool.

“Insurance scoring allows me to offer more options and help customers of all income levels and backgrounds save money,” says independent agent Piilani Benz of Alliance West Insurance in Tacoma, Washington.

And that’s a future insurers want for all independent agents and consumers.

Heather Day is general manager of agency sales and distribution at Progressive.