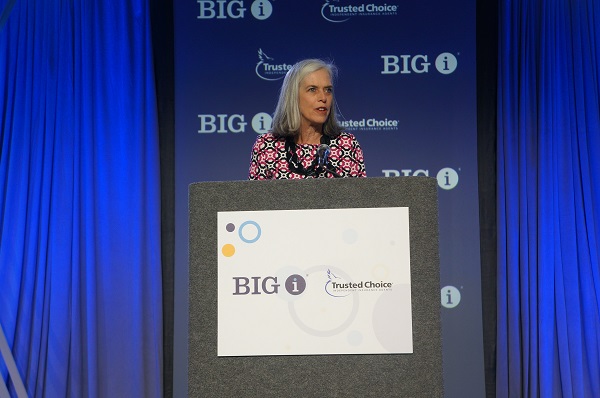

Rep. Katherine Clark: Agent Advocacy Makes the Entire Economy Successful

Rep. Katherine Clark (D-Massachusetts), assistant speaker of the U.S. House of Representatives, voiced her support for legislative solutions that will make families, businesses and communities stronger.