Top 5 Most-Read Articles in Independent Agent in June

Erie Insurance and Philadelphia Insurance Companies grappled with extended system outages, prompting errors & omissions concerns for independent insurance agents.

Erie Insurance and Philadelphia Insurance Companies grappled with extended system outages, prompting errors & omissions concerns for independent insurance agents.

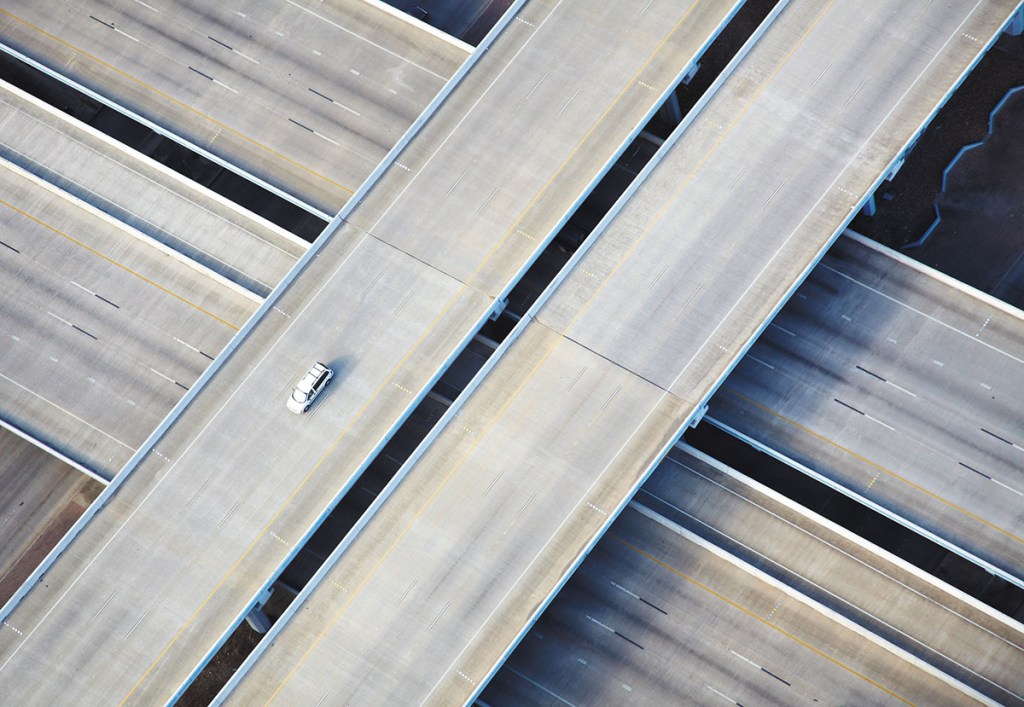

One of the largest errors & omissions exposures for insurance agents and agencies occurs during the placement of personal or commercial auto policies.

Inadequate limits are an all-too-common claim in independent insurance agency E&O. And with inflation today outstripping even the inflation guards inserted on some policies, these claims are becoming more frequent.

You and your customers have been battered these past few years by various catastrophes of near-biblical proportions. Your customers don’t just want a good year, free of missing coverages and underinsured losses. They need it.

Insurance agents need to be careful and take appropriate steps to avoid errors & omissions claims that allege they failed to offer uninsured/underinsured motorist and umbrella coverage.

As many as 13% of all U.S. drivers are uninsured, according to the Insurance Research Council. Protect your customers and yourself by offering uninsured/underinsured motorist coverage.

Want to avoid getting a letter from your E&O carrier informing you of an uncovered, excess exposure? When selecting E&O coverage limits, ask—and honestly answer—these questions.

For product liability or commercial clients, QBE North America offers a new manufacturing errors & omissions endorsement as a standalone form that combines three key coverages—product, impaired property and work—in one form.