Many people within 10 years of the traditional retirement age of 65 have not saved enough to maintain a similar standard of living in retirement.

It’s the time of year when people are focused on spending, not saving. But saving should be top of mind year-round.

A recent study from the General Accounting Office (GAO) indicates that many people within 10 years of the traditional retirement age of 65 have not saved enough to maintain a similar standard of living in retirement. According to the study, about half of households age 55 and older have no retirement savings in a 401(k), IRA or the like.

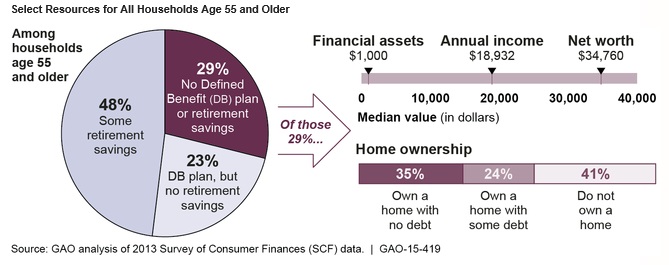

What’s more, the GAO's analysis of the 2013 Survey of Consumer Finances found that many older households without retirement savings have few other resources to draw from during retirement:

For example, among households age 55 and older, about 29% have neither retirement savings nor a pension plan, which typically provides a monthly payment for life. Households that have retirement savings generally have other resources to draw from as well, such as non-retirement savings or pension plans. Among those with some retirement savings, the median amount is about $104,000 for households age 55-64 and $148,000 for households age 65-74—equivalent to an inflation-protected annuity of $310 and $649 per month, respectively. Social Security provides most of the income for about half of households age 65 and older.

Unfortunately, most people overestimate the value of a lump sum of money to provide monthly income throughout their retirement. One common rule of thumb: People who don’t plan to outlive their income should not withdraw more than 4% of their 401(k) plan or IRA savings each year.

For example, if someone accumulates $250,000 at age 65, and they want their funds to provide the same purchasing power over 30 years, they should not withdraw more than $10,000 annually. If their only other source of income is their Social Security benefits and they have a $2,000 monthly benefit, they would have $34,000 in annual pre-tax income to pay for their Medicare Part B premiums and a Medicare supplement policy.

One recent study by the Employee Benefit Research Institute estimates that the median health care per capita expense at age 65 is $4,660 and is projected to be $18,030 at age 85. Even with Social Security cost-of-living adjustment increases, health care costs could consume 50% of a typical retiree’s income.

The only real solution is for people to save more for retirement. In some cases, they may not have much discretionary income to save. But often, they simply choose to spend the money they currently have instead of putting it away for later.

New cars today typically last for 200,000 miles or more. Assuming the vehicle clocks 15,000 miles annually, most new vehicles will last for 14 years. But auto researcher R.L. Polk claims that the average new car owner keeps their car for only about six years. Since autos represent a depreciating asset, it appears that many people are trading in their cars more frequently than necessary. The average purchase price of a new vehicle is about $31,000. People need reliable transportation, but considering the average purchase price of a new vehicle is about $31,000, many people would be better off maintaining an older one and redirecting the savings into their 401(k) plan.

This is certainly the season to help those in need. But when it comes to personal expenditures, we should all maintain a “save, don’t spend” mentality.

Dave Evans is a certified financial planner and an IA contributor.