In the first installment of a new monthly column offering an off-beat take on current trends in the industry, find out why it’s time to prepare for an insurance winter.

At Big I Advantage®, we are hearing that there are tracks north of the wall that indicate change may be afoot. If this change is like the change between 2002-2004—or bigger still, like the mother of all hard markets in 1986-1988—it is best to prepare for an insurance winter. Apologies if you didn’t follow Game of Thrones, but the analogy of dark days coming to the insurance kingdom seems fitting.

We first heard of strange happenings via a large agency errors & omissions renewal in the London market, where prices went up and terms tightened. To me, the British Isles always seems like the mythical Westeros and London is the northern capital Winterfell, which will see the monsters of an insurance winter first, just like Winterfell was first to see White Walkers coming south.

Now, the winter seems to be sweeping across the Atlantic. Stories have come in from Big “I” state associations, mostly focused on larger accounts. Then, a few weeks ago, during a weekly call discussing strategy with a company partner, we chatted about a headline indicating that CNA was raising prices on nurse's professional liability.

Right after that, evidence that USLI and Munich Re were implementing substantial rate increases with personal umbrellas appeared. Now, I see reports in many places on the insurance market firming. Is there a pattern?

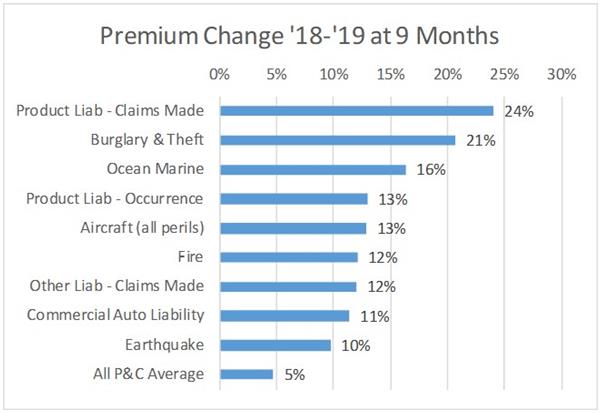

Well, it sure feels like change, but I am a data guy—so show me the numbers! What do the nine-month industry premiums indicate?

This data comes from insurer Yellow Books, which was filed with each writing insurer’s regulator and then aggregated by A.M. Best. Yes, the average change for all property & casualty is not much at 5% but look at product liability.

This data comes from insurer Yellow Books, which was filed with each writing insurer’s regulator and then aggregated by A.M. Best. Yes, the average change for all property & casualty is not much at 5% but look at product liability.

And then, consider that all of the top ten Lines of Business that show increases, all show increases above 10%. That looks like firming prices in those lines at least. By comparison, in 2017 and 2018, only a few lines hit double-digit increases at nine months—and most of those showed big decreases the year before or the year after.

Every industry watcher is asking the same question: Where are these tracks headed?

No one knows for sure. My theory is that specialty insurers will lead the way to general increases and reinsurers will increase costs behind the scenes, mostly on commercial lines. We'll keep watch. But as we know, with rising prices comes a higher risk of E&O claims.

If you are interested in the insurance company specifics that led me to my theory, email me and I'll share some examples of individual insurers that concentrate on specialty lines and what they experienced in direct written premium changes in the first nine months of 2019.

My data is pulled from A.M. Best Rating Services in a custom report for any policy-issuing insurer that writes any other liability or medical malpractice. It looks to me like insurers focused on specialty lines of business are increasing prices dramatically, but I’m curious what you see.

This Student of Industry article is the first installment of a new monthly column exclusively on IA Magazine. Keep an eye on Thursday’s weekly News & Views e-newsletter in January for the next off-beat take on current trends in the insurance industry.

Paul Buse is president, Big I Advantage® and Big “I” Reinsurance Company.

Data by A.M. Best Rating Services. “Special Report: First Look: 9-Month 2019 Property/Casualty Financial Results.” Published Nov. 21, 2019.