Of nearly 3,000 affiliated and unaffiliated insurers, 142 instances exist where one insurer has a nearly identical name to another different insurer. Accurate names matter when finding the financial strength of an insurer.

When I hear, "strip clubs, a $25,000 sniper rifle, federal agents and an insurance company," you've got my attention—and that's exactly what I saw recently on an episode of CNBC's “American Greed." Little did I know how sensational the story would turn out to be.

The name of the insurer cited in the episode was "Indemnity Insurance," a company I believed to be a Chubb company. The name sounded familiar, but could it really be?

Not at all. The companies' full legal names make it all clear—the insurer in the episode has an amazingly similar name, Indemnity Insurance Corporation, to the Chubb insurer, Indemnity Insurance Company.

Indemnity Insurance Corp.—II Corp. for short—is definitely not a Chubb-related insurer. It was an insurer that was focused on other liability occurrence lines of business, such as liquor liability and general liability for bars and music venues. It grew from $2.7 million in premiums in 2013 to over $40 million in 2017. The episode of “American Greed" picks up as II Corp. neared regulatory take-over in November 2013. You can tune into that episode to catch the details in full.

For our purposes, all you need to know is that II Corp. went into liquidation in June 2014—and the owner and CEO, Jeff Cohen, is serving 37 years in federal prison for fraud. Two years prior to going under regulatory supervision, its rating was actually a very good A-.

On the other hand, Indemnity Insurance Company—II Co. for short—is a Chubb-affiliated insurer. It also writes the same general line of business but the similarities end there. II Co. is rated A++ and has been writing over $1.2 billion in all commercial lines through independent agencies for some time.

So, why beyond entertainment value should you care about II Corp. versus II Co.?

As agents and students of the industry, you should know insurer insolvencies are highly correlated with litigation—and that litigation can involve insurance agents. We'll take a look at insurer insolvencies and cover the litigation aspect next month.

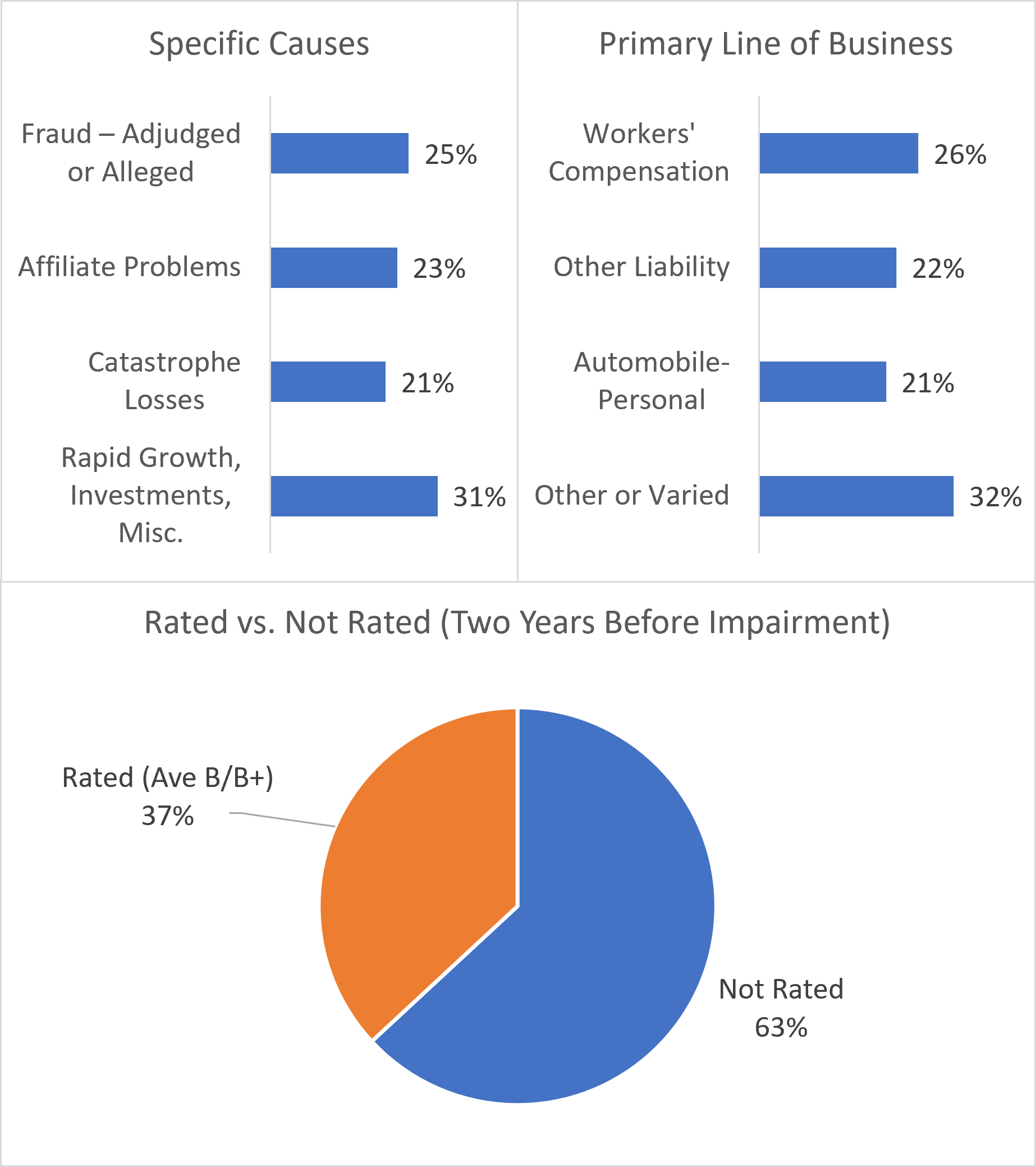

Below is a summary from the AM Best Company's December 2019 review of 374 insurer impairments from 2000 to 2018. You can see II Corp. fits two high-probability areas but not the last one. The cause of the impairment was fraud and writing Other Liability, but they fell outside the averages on their rating two years before as being rated A-.

2000-2018 P-C Insurer Impairments

Source: A.M. Best Special Report: 2018 US Property/Casualty Impairments (Specific Causes and Primary Line of Business categories were combined for brevity)

Accurate names matter and no better example exists than II Corp. versus II Co. But how often can this sort of name confusion take place?

More than you might think. Of the nearly 3,000 affiliated and unaffiliated insurers, 142 instances exist where one insurer has a nearly identical name to another different insurer. Of these—and after removing a few that start with two common words where a third specific work makes the difference obvious (for example, New York XYZ vs. New York ABC)—121 instances of possible mistaken identity remain.

Further, of the 121 close matches, there are 73 instances where the ratings between the two similarly named insurers vary significantly, such as a variance of two full letter grades or an A or B letter grade and Not Rated (NR). Beyond that, the direct written premiums of the insurers with significantly lower ratings totaled over $1 billion in 2019.

What can you do and, as students of the industry, what should you know? You can easily look up any insurer. Eliminating any confusion is as simple as looking up carrier names at AM Best. Other rating companies may also provide the same sort of public look-up ability but AM Best is common and the ratings are well-recognized.

Once an insurer is concretely identified, anyone can obtain the following information on any insurer: group affiliation, financial strength rating (A++ to F or NR), the age of the insurer, its corporate address, website, phone, ownership structure (stock or mutual), and Financial Size Category form I to XV.

Before leaving you for this week, a word of caution on NR ratings is in order. While you can see from the insolvency study that NR ratings are common with the insurers that become impaired, do not conclude anything from NR beyond what it stands for. Some insurers choose not to be rated by AM Best and some may not have the years in business to allow them to be rated. The point is, NR means just that, "Not Rated."

If you have an insight or topic you are interested in looking into, email me. Keep an eye on Thursday's weekly News & Views e-newsletter in November for the next off-beat take on current trends in the insurance industry.

Paul Buse is operations and strategic advisor, Big I Advantage®