The insurance industry's transparency makes gathering information as straightforward as pulling the rate filings. What can you learn from this information?

I am often amazed by the transparency in the insurance industry. Where else can you look at your competitors’ plans for what to charge (rates) or how they bring their product to market (forms)? And if it suits, underwriters can essentially freely copy their competitors.

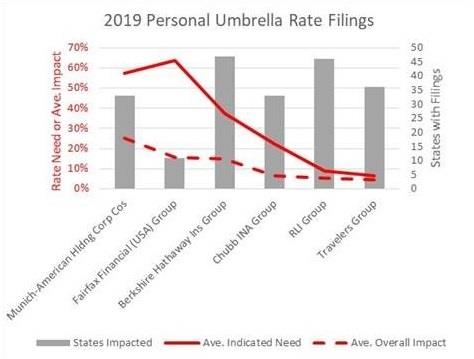

As an example of what this transparency can show us, below is a graph of the rate filings for various insurers that write personal umbrella insurance: excess liability with expanded scope of coverage that applies above required underlying insurance.

Underlying insurance typically includes personal auto and homeowners but can also include excess coverage for a boat or a rental property.

The industry's transparency makes gathering this information as straightforward as pulling the rate filings. It's that easy in our industry: accessible, very complete and free public information.

What can you learn from information like this?

First, the average indicated rate tells you some insurers have let themselves get well behind the loss trends on this line of business. The average impact tells you insureds may see a $1,000 umbrella policy jump to $1,250 with one insurer—and that's the average. The grey bar shows the number of states impacted by the average filing.

What’s the point of the graph for independent agents? It tells us that personal umbrellas are on the move making now the ideal time to spread the word that your agency writes this line of business on your website and on social media.

Insurers in the same marketplace are all examining each other's practices and set their strategy to take advantage of the public information. Of course, they also know that if they raise their rates it will also be public information. And if they make a change in their policy form, their competitors will know.

Even changes in underwriting rules and applications must be disclosed in some states. Our industry operates in many ways very near what Adam Smith, "the Father of Capitalism," would advocate for: competition with free flow of information.

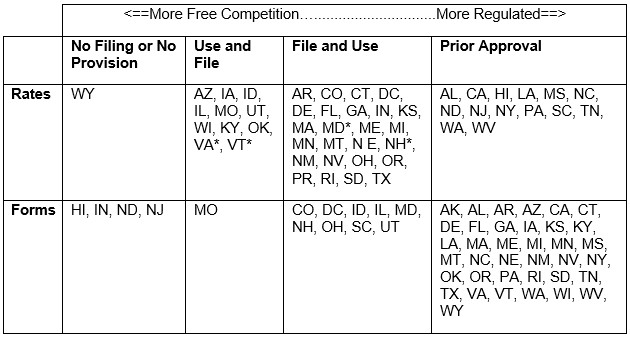

As students of the industry, you should understand how rates and forms are regulated in your state. If an insurer wants to change a policy form, rate or, sometimes, even an underwriting rule, the insurer must assure it receives state approval.

In some states, it must be approved before the rate or form is used, which is known as “prior approval.” In others, the justification for the change must be filed but then it can be immediately used, known as "file and use." Some states allow an insurer to use a new rate or form right away but then they must file information within a set number of days, known as "use and file." Finally, some states use a mixture and allow some changes without approval, but demand that bigger changes are approved, known as "flex band," which is a rate-filing procedure and is not used for forms or rule changes.

Below is my personal cheat sheet based on several free public sources of state approaches to rate and form regulation. It's my list and comes with no guarantees of accuracy as states may change laws at any time, so you’ll want to confirm before relying on the information in this cheat sheet and update it as necessary. Here is my quick summary view:

*Indicates a limit is set on freer competition aspects of requiring filings. In these states some limit is placed when more immediate use is available to an insurer of a rate change.

The best and most accurate way to stay up to date with the rules in any one state is to use the National Association of Insurance Commissioners website for filing checklists, which provides contact information and typically includes the state-specific references on rate, form and insurer filings.

This Student of the Industry article is part of a new monthly column exclusively on IA Magazine. Keep an eye on Thursday’s weekly News & Views e-newsletter in March for the next off-beat take on current trends in the insurance industry.

Paul Buse is operations and strategic advisor, Big I Advantage®.