The past decade has been the golden age of insurance agency mergers & acquisitions. But after COVID-19 emerged on the world stage with a vengeance in late January, activity has slowed.

The past decade has been the golden age of insurance agency mergers & acquisitions. Following the Great Recession and fueled by aggressive private-equity investors leveraging cheap debt, consolidation rapidly accelerated and peaked in 2019, with 659 announced insurance agency sales. Agency valuations concurrently skyrocketed to unimaginable levels, as over 40 well-capitalized buyers competed for deals.

For years now, the $64,000 question has been, “When and how will this crazy M&A environment cool off?” Is the answer 2020 and COVID-19?

COVID-19 emerged on the world stage with a vengeance in late January, bringing quarantines, economic shutdowns, and mass layoffs. The steady stream of economic growth came to a screeching halt, and the U.S. economy shed over 20 million jobs in April alone. With no vaccine in sight, it’s anyone’s guess when the economy will recover and Americans will return to “normal.”

So, how does this affect the M&A market?

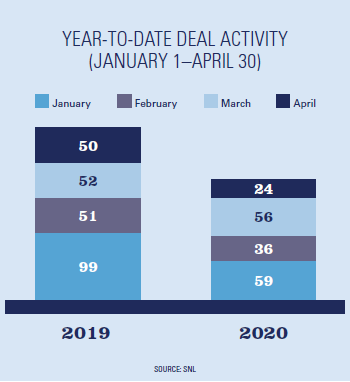

Things are slowing down. The number of deals closed between January and April 2020 fell 31% compared to 2019. In April alone, announced transactions fell by 52%. Yet, early May results reveal that this is not necessarily a decline in deal activity, but rather a delay as many of the originally expected April deals closed in May. Buyers and sellers scrambled in March and April to care for employees and clients and to adapt to a new world of remote working, leading to inevitable closing delays.

Slowing down does not mean stopping. Buyers and debt markets, critical to private equity investors, report that they are “open for business.” Buyers are moving forward more cautiously as they try to figure out how to price and close transactions in this new environment. Sellers question whether this is the right time to go to market.

Valuations for high-quality agencies remain strong. Given the uncertainty surrounding economic recovery timing, buyers increasingly attempt to price new offers at pre-COVID-19 multiples, with some risk-sharing on the part of sellers. Some buyers introduced features such as “live-outs,” where buyers pay pre-COVID multiples and sellers leave some money on the table at close for 12-18 months, contingent on their ability to keep revenues flat over that period.

Buyers are still playing the long game. Quality remains quality, even in a slow-down. Buyers still hunt for valuable insurance assets to support their own growth requirements. That said, buyers will be pickier, focusing on well-diversified operations serving a broad array of industries. Agencies with significant business concentrations in industries especially hard-hit by the pandemic are unlikely to attract considerable attention for the time being.

Industry fundamentals remain positive. Two growth surveys completed by Reagan Consulting in April and May 2020 indicate most agents still plan to post nominally positive growth in 2020. Q1 growth and profitability results were the strongest for the industry in years. If markets harden, 2020 positive growth becomes even more likely. Although the number of well-capitalized buyers has diminished somewhat, there is still a historically large number of acquirers available to compete for deals.

These are unprecedented times and no one knows the ultimate impact of COVID-19 on the M&A environment. The economic recovery and its shape—V, U, L or Nike “swoosh”—will tell much of the story.

Is the M&A party ending? The music has been turned down, but stay tuned—second-quarter M&A results may provide the answer we seek.

Tom Doran is a partner at Reagan Consulting. This article is a new, quarterly column exclusive to Independent Agent magazine.